A Treatment Revolution is Underway: All-Oral Therapies Transform Global Hepatitis C Antiviral Market

Frost & Sullivan: The market is looking for a reasonably priced and convenient alternative to Gilead’s blockbuster Sovaldi

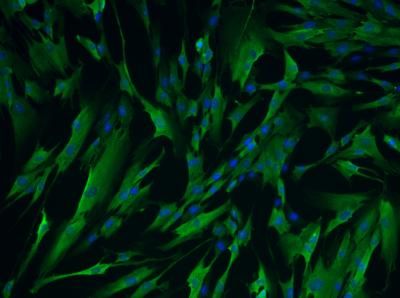

drug development for hepatitis C virus (HCV) antivirals has amplified with rising incidence rates and the intense need for curative therapy in the absence of a preventative vaccine. Change is underway as the market moves away from protease inhibitors and interferon regimens towards highly effective, easily-tolerated, interferon-free oral therapies.

Gilead’s mega blockbuster Sovaldi is the first of these novel therapies to launch into the market and is projected to hit close to $10 billion during its first year. Several strong competitors, however, are maneuvering aggressively to narrow the market gap by introducing a HCV antiviral that can outdo Gilead’s drug.

New analysis from Frost & Sullivan’s A Product and Pipeline Analysis of the Global Hepatitis C Virus (HCV) Antiviral Market expects robust demand for HCV antivirals as around 160 million people across the globe are chronically infected with HCV, and at least 350,000 die annually from HC-infected liver diseases such as liver cancer and conditions requiring transplantation. The United States alone accounts for nearly five million of the total HCV-affected population, with the majority being baby boomers entering the 65-plus age bracket.

“Evidently, chronic infection with HCV remains a serious public health threat,” said Frost & Sullivan Healthcare Principal Analyst Randy Budros. “Until an efficacious preventative vaccine emerges, the patient strength will remain sizable due to the likelihood of high-risk behaviors from a substantial portion of the population and the emergence of resistant viral strains.”

While Gilead’s Sovaldi holds promise in fighting the HCV, its astronomical price – $84,000 for a 12-week course of treatment – has unleashed a firestorm of criticism from government agencies, patient advocacy groups, and payers. Indeed, the prohibitive price has triggered a Congressional request for Gilead to justify its pricing, which is projected to increase Medicare Part D spending by as much as $6.5 billion in 2015 alone.

“Gilead and other future market entrants have to create a compelling pricing rationale by driving home the potential cost savings from a high-performance, all-oral regime, zeroing in on the downstream cost saving such as the reduction of liver transplants,” noted Budros. “Equally crucial is the need to make HCV antivirals more affordable and accessible to patients.”

With recent clinical data showing close to 100-percent cure rates for Sovaldi, future contenders will be hard pressed to succeed in the marketplace. Competitors must aim to satisfy the until now unmet need for a once-daily, ribavirin-free, all-oral, pan-genotypic regimen that has a short treatment duration.

Other news from the department business & finance

Get the life science industry in your inbox

From now on, don't miss a thing: Our newsletter for biotechnology, pharma and life sciences brings you up to date every Tuesday and Thursday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.