Emerging markets key prospects for interventional cardiac device manufacturers

Frost & Sullivan: Manufacturers must expand capabilities and capacity through strategic partnerships in order to fulfill demand

A high degree of unmet clinical needs, the rising prevalence of ailments such as coronary artery diseases and hypertension, as well as increasing disposable incomes are creating robust opportunities for emerging interventional cardiac devices in emerging countries. Although the U.S. and European markets will witness the highest growth, device manufacturers must focus on developing economies such as India and China, where the market is growing between 12 and 15 percent per annum.

New analysis from Frost & Sullivan’s analysis on The Global Emerging Interventional Cardiac Devices Market finds the market earned revenue of $1.49 billion in 2013 and estimates this to reach $6.93 billion in 2020. The analysis covers devices for the following segments: transcatheter heart valves, renal denervation, bronchial thermoplasty, bioresorbable stents, and fractional flow reserve.

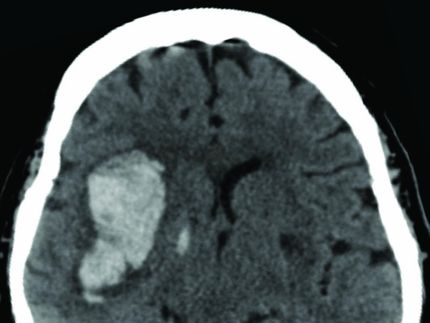

“Cardiac disorders, including atrial septal aneurysm and patent foramen ovale that have been recognized as possible risk elements for ischemic stroke, are evolving into potential markets for interventional cardiac devices worldwide,” said Frost & Sullivan Advanced Medical Technologies Research Analyst Swathi Allada. “Many companies have already forayed into this sector with products cleared under Food and Drug Administration humanitarian device exemptions.”

However, as with any emerging technology, the shortage of specialists restrains the use of interventional cardiac procedures. The current workforce in cardiology is insufficient to meet the escalating need across the globe. To resolve this challenge, official training programs have been set up by various academic institutions as well as companies like Edwards Lifesciences and Medtronic.

The development of these products will likely shape the overall interventional cardiology market, and the successful adoption of these emerging products will result in significant market growth rate.

Complex purchasing systems also hinder the adoption of interventional cardiac devices, particularly in Asia-Pacific (APAC). In this increasingly competitive market, APAC countries face an alarming rise in cardiovascular disorders and account for half of the global burden of diseases. This situation will likely worsen during the next few years, as the region has an ageing population with an increasingly unhealthy lifestyle.

Another challenge peculiar to the region is caused by heavy subsidization of healthcare by governments. Lower costs heighten hospitalization rates, and, in turn, healthcare costs, severely impact the economy and the market.

“Nevertheless, the urgent requirement to decrease hospital stay times is driving minimally invasive interventional procedures, which ensure quick recovery and lower risk of complications,” noted Allada. “As minimally invasive interventional cardiac procedures become the solution of choice among patients and the medical fraternity, demand for interventional cardiac devices will grow.”

Acquiring added capabilities and expanding capacity through long-term strategic partnerships will be crucial for device manufacturers. Repositioning product and service offerings to enhance value for clients will help strengthen their foothold in this dynamic landscape.

Other news from the department business & finance

Get the life science industry in your inbox

From now on, don't miss a thing: Our newsletter for biotechnology, pharma and life sciences brings you up to date every Tuesday and Thursday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.