Diamyd Medical broadens diabetes pipeline with acquisition of Nurel Therapeutics

Diamyd Medical AB emerged as a global biotechnology company as shareholders approved the acquisition of Nurel Therapeutics Inc at a General Assembly Meeting in Stockholm. The Pittsburgh-based biotech adds significantly to Diamyd Medical's pipeline for diabetes which now includes both a therapeutic vaccine for autoimmune type 1 and type 2 diabetes as well as therapies for diabetic pain. The merger is expected to close on Friday, December 16.

Diamyd shareholders approved the issuance of common stock to Nurel shareholders in connection with the merger. Nurel shareholders will receive a total of about 223,208 Diamyd B shares. This reflects an assumed Diamyd B share value of SEK 55, which corresponded to a 15% premium as of the deal signature date the 21st of November. In addition, Diamyd shareholders approved the issuance of an additional approximate 110,000 Diamyd shares against convertible loans used previously to finance Nurel, which in total represents a dilution of about 4% to Diamyd shareholders. The merger will create strong synergies between Diamyd Medical and Nurel, while having little effect on Diamyd's financial position and burn rate.

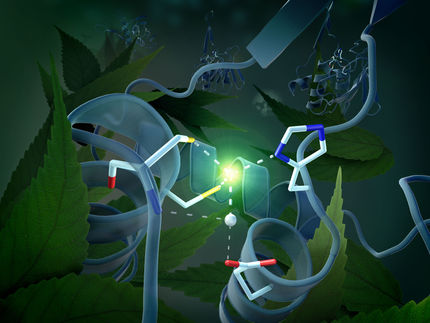

"Nurel and Diaymd Medical both work in diabetes and both have a GAD-based lead compound. We differ in that the GAD is used for two totally different and non-overlapping aspects of diabetes: (1) the treatment of the actual disease itself, and (2) the treatment of pain resulting from diabetes. The acquisition of Nurel brings a tremendous amount of synergy to the table, which makes the deal very attractive and beneficial to our shareholders," says Anders Essen-Moller, President and CEO of Diamyd Medical.

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.