Biomira Announces Acquisition of ProlX Pharmaceuticals

Advertisement

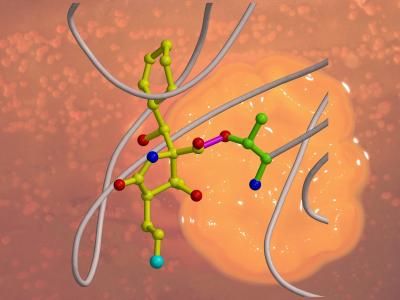

Biomira Inc. announced that it has acquired ProlX Pharmaceuticals Corporation, of Tucson, Arizona, and Houston, Texas, a privately-held biopharmaceutical company focused on the development of novel therapeutics for the treatment of cancer. ProlX is developing small-molecule drugs that inhibit redox and cell-survival signaling proteins.

The acquisition shall give Biomira a broadly-based portfolio of oncology products, including one product candidate expected to enter phase 3 by year end (Stimuvax(R)), one product expected to enter phase 2 in the current quarter (PX-12), and two products expected to begin clinical trials over the next 6 to 12 months, as well as several additional pre-clinical candidates.

Promptly following closing Biomira will pay U.S. $3 million in cash and approximately 17,878,000 shares of Biomira common stock (subject to certain resale restrictions) in return for all of the outstanding stock of ProlX. In addition, and subject to applicable regulatory requirements, there may be up to three future payments based on the achievement of specified milestones. A payment in Biomira common stock (with registration rights) of U.S. $5 million is due upon the initiation of the first phase 3 trial of a ProlX product. Another payment in Biomira common stock (with registration rights) of U.S. $10 million is due upon regulatory approval of a ProlX product in a major market. Finally, under certain circumstances, ProlX shareholders may also receive a share of revenue from a potential collaboration agreement for a ProlX product in a specified non-oncology indication.

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.