Biotage acquires PhyNexus

Strengthening position in lab-scale purification of biomolecules

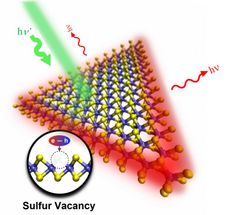

Biotage AB has entered into an agreement to acquire all outstanding shares in the privately held company PhyNexus, Inc. (PhyNexus) based in California, US, for a total purchase price of approx. USD 21.5 million financed through a combination of newly issued shares in Biotage and existing cash at hand. The acquisition is expected to strengthen Biotage’s position as a separations company within the growing biomolecule arena. Biotage will be able to provide its global customers an enabling automation platform based on Dual Flow Chromatography and patented tip technology for higher throughput purification of biomolecules such as proteins, plasmids and antibodies at the lab-scale. Biotage predicts that this platform has the future potential to address a growing multi-billion USD market. Biotage believes that the acquired technology platform will enable enhanced high throughput workflow approaches for clinical, forensic, food and environmental testing through dispersive solid phase extraction in combination with high throughput pipetting robotics and its new media development program.

PhyNexus, which to date predominantly has sold its products to its near-by US home market, generated net sales of USD 3.1 million in 2017, corresponding to approx. SEK 28 million, and an operating result (EBIT) of USD -0.1 million, corresponding to approx. SEK –0.9 million. PhyNexus had 14 full-time employees in November 2018. Biotage estimates that the launch of new products currently in development and synergies in sales and operating expenses over time will lead to an operating profitability margin in the acquired business in level with what today is generated by Biotage’s current business.

Torben Jörgensen, CEO of Biotage, comments: "The acquisition of PhyNexus is in line with our strategy to grow our separation business through expansion into new application areas. This transaction enables PhyNexus’ products to reach a larger global market through Biotage’s direct sales organization, at the same time as Biotage obtains access to customers in industries where Biotage historically has not been as active. The acquisition is complementary to our existing offering and enables us to better address the growing biomolecules market. We are very much looking forward to accelerate our efforts in this fast emerging area.”

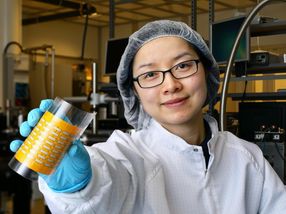

Doug Gjerde, founder and CEO of PhyNexus, comments: "PhyNexus has developed a unique, proprietary platform technology that delivers high throughput purification capability with improved results across multiple applications in biologics drug discovery, research and development, and diagnostic applications. The innovative technology with Dual Flow Chromatography together with patented tip-based consumables deliver higher throughput and improved work flows for those engaged in biomolecule research and development. We are excited to partner with Biotage for the next phase of PhyNexus’ development. This combination will allow PhyNexus’ product offering to expand its footprint globally and open up new opportunities for developing and bringing new innovative products to the market."

Approximately 94 percent of the shares in PhyNexus are acquired from the main shareholders of PhyNexus through a share purchase agreement with Biotage against both share and cash consideration. The remaining approx. 6 percent of the shares in PhyNexus are acquired by Biotage through a merger of PhyNexus into a wholly-owned subsidiary of Biotage against cash compensation. The transaction is expected to be completed in January 2019 and is subject to customary closing conditions.

The total purchase price for all shares in PhyNexus is approx. USD 21.5 million, corresponding to approx. SEK 195 million, on a debt free and cash free basis. The purchase price will be adjusted for actual net debt at the closing date. Approx. USD 10.0 million (corresponding to approx. SEK 91 million) of the total purchase price consist of expected future additional purchase price payments for the years 2019 to 2023 that will be based on future results. The remaining purchase price of approx. USD 11.5 million (corresponding to approx. SEK 105 million) will be paid at the closing and comprises approx. USD 6.6 million (approx. SEK 60 million) in 487,337 newly issued shares in Biotage and approx. USD 4.9 million (approx. SEK 45 million) in cash.

The transaction will be financed through an issuance of 487,337 new Biotage shares corresponding to a value of approx. 6.6 million USD (approx. SEK 60 million), combined with Biotage’s existing cash at hand. Issuance of new shares will be resolved upon by the Board of Directors of Biotage in connection with closing of the transaction and will be made pursuant to an authorization granted by the Annual General Meeting 2018. The shares will be issued to the main shareholders of PhyNexus (including the largest shareholder Doug Gjerde, representing approx. 60 percent of the shares and votes in PhyNexus) and additional shares may be issued in connection with post-closing price adjustments and earnout payment