Escalating Costs of Drug Development Drive the Pharmaceutical Companies to Tap Opportunities in Emerging Markets

Advertisement

The increased cost of drug development has impelled pharmaceutical companies to seek better opportunities in emerging markets to successfully expand and sell their products. Most pharmaceutical companies consider emerging markets lucrative due to their economical infrastructure and manpower costs and a significant untapped market potential with a large population.

New analysis from Frost & Sullivan, Global Pharma-Biotech Alliance Analysis, finds that healthcare reform programmes in emerging markets have dramatically improved the level of healthcare coverage in these countries. The regions covered in this research service include the so-called BRIC countries, Brazil, Russia, India, and China. In fact, China is expected to be the third fastest growing pharmaceutical market in the world by 2011.

“With companies focusing on emerging markets, they would need to address the varying medical requirements of each of these markets,” says Frost & Sullivan Research Analyst Swetha Shantikumar. “Therefore, there will be an overall shift in the pharmaceutical industry from a very Western centric model to a global one.”

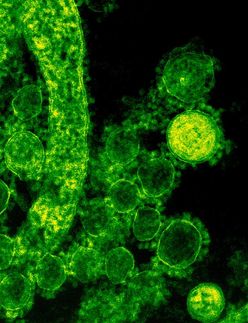

Disease areas that were once considered niche are now given priority and the more prevalent disease therapeutic areas in the mature markets have taken a backseat. Vaccines, biologics, over the counter (OTC) candidates and generics are the principal revenue generators in the emerging markets.

However, weak intellectual property (IP) laws, escalating drug costs, and low reimbursement rates for drugs plague the current healthcare system in China. Implementation of the plan will go a long way in attracting financial investments from pharmaceutical companies across the globe as the plan also involves revamping IP laws and providing healthcare coverage to all. This will create a huge market potential that the pharmaceutical companies can capitalise.

“For instance, one of the main drawbacks of the Indian pharmaceutical industry is weak IP laws and policies,” explains Shantikumar. “The new Indian patent code has addressed that and several other issues, yet there remains a clause that disallows patents for treatments that are not more efficacious than those already available.”

Although the emerging markets have several restraints, it does not stop the big pharmaceutical companies from investing in countries like India and China, which offer greater advantages such as intellectual talent pool, cheap land and labour, and investor-friendly governments.

“These companies need to re-evaluate their priorities and develop customised strategies that are suitable for the emerging markets,” concludes Shantikumar.