Aptamer Group raises $2.2M investment

Advertisement

Rapidly growing biotech business,Aptamer Group Ltd, has closed its Series A investment round after attracting international interest, securing $2.2m of funding from overseas investors to support its pioneering aptamer development programme.

The funding will enable the expansion of the York Science Park-based business, creating ten new positions in technical, sales and administration roles which will support its continuous growth.

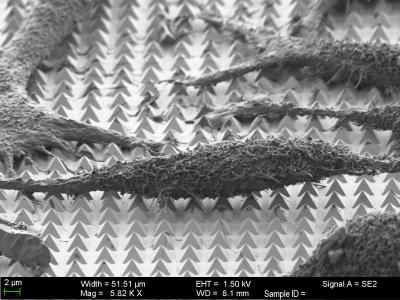

The Company is a key player in the global aptamer market, specialising in identification, development and characterisation of nucleic acid aptamers - a synthetic alternative to antibodies - which are fast becoming alternatives to traditional antibody approaches – replacing or filling the current gap in the antibody market.

Aptamer Group was founded in 2008 by Chief Executive Officer, Dr Arron Tolley and Chief Technical Officer, Dr David Bunka, who lead the now 16-strong team serving a global customer base of more than 50 organisations and has several of the top ten global Pharma companies as its customer base. The business operates four separate companies under the Aptamer Group ‘umbrella’ and has recently added an office in Boston (United States) where the aptamer market is growing rapidly.

Chief Executive Officer, Dr Arron Tolley says: “Aptamer technology is rapidly evolving and will have a significant effect on the life sciences market in the coming years due to our ability to rapidly discover aptamers - combined with advantages in the manufacturing process such as the stability of aptamers, the cost of manufacturing and the reproducibility of results when compared to antibodies. The investment will allow us to drive forward our pre-clinical discovery programmes involving the development of aptamer drug conjugates (ApDCs) which are set to become a revolutionary approach to targeted drug delivery.”

The funding round was supported by Netherlands-based biopharmaceutical investment company, Meneldor - founded by Dutch entrepreneurs Frans van Dalen and Paul Lelieveld. Frans is a founding partner of Synthon Holdings and has 30 years' experience in the development of New Biological Entities (NBEs) and Biosimilars. Paul is a serial investor and has invested in numerous early-stage life-science companies including Ablynx, which recently sold to Sanofi for $4.8bn.

Says Meneldor: “We believe that aptamer technology represents a paradigm shift in drug delivery methodology. We have invested in Aptamer Group Ltd due to their progressive approach and unique technology platform, which can select aptamers significantly better and faster with the superior binding properties.

We believe that this will lead to the development of new medicines and represents an exciting investment opportunity. We believe this company and its management team has the potential of becoming the next Ablynx”.

Other news from the department business & finance

Most read news

More news from our other portals

See the theme worlds for related content

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous

Topic world Antibodies

Antibodies are specialized molecules of our immune system that can specifically recognize and neutralize pathogens or foreign substances. Antibody research in biotech and pharma has recognized this natural defense potential and is working intensively to make it therapeutically useful. From monoclonal antibodies used against cancer or autoimmune diseases to antibody-drug conjugates that specifically transport drugs to disease cells - the possibilities are enormous