BELLUS Health signs agreement to acquire Innodia

BELLUS Health Inc. announced that it has signed a definitive agreement to purchase capital stock of Innodia Inc. This will result in the BELLUS Health Group owning 100% of the capital stock, thereby acquiring all of the business of Innodia including the intellectual property assets related to its diabetes and obesity projects. BELLUS Health has also effectively regained the rights to a diabetes project and certain compounds previously licensed by it to Innodia and, as a result, now holds the exclusive rights to BELLUS Health's diabetes platform and all related compounds. Innodia Inc. is a private company engaged in developing compounds for the treatment of diabetes, obesity and related metabolic conditions and diseases.

The purchase price, in the amount of approximately $1.3 million including the purchase of the outstanding debt from Investissement Québec, will be paid by the issuance from treasury of BELLUS Health common shares. Additional consideration consisting either in treasury shares or cash, at the option of BELLUS Health, is conditionally payable on the first anniversary of the closing of the transaction, contingent upon the determination of the value of certain assets at that time. The total purchase price is expected to approximate the net assets of Innodia. Innodia has secured credit facilities available of approximately $3 million and tax losses of more than $25 million. The Toronto Stock Exchange has issued an approval letter in respect of the transaction subject to customary conditions. A significant number of the shares to be issued will be subject to a hold period under applicable securities legislation.

"BELLUS Health's acquisition of Innodia is a timely opportunity because it allows the Company to gain access to Innodia's expertise and rights in diabetes and obesity at an attractive price and will help accelerate our own projects in diabetes and expand our pipeline through Innodia's identified candidate leads," said Dr. Francesco Bellini, Chairman, President and CEO of BELLUS Health. "Several members of the Innodia research team will share their know-how in diabetes and metabolic syndrome, thereby reinforcing the existing expertise of the BELLUS Health Group and prove useful to further advance the related programs," Dr. Bellini concluded.

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

More news from our other portals

Last viewed contents

GPC Biotech Announces Granting of European Patent Related to Satraplatin for Treating Tumors Resistant or Refractory to Taxanes

Promising nose spray could prevent, treat COVID-19 - A California-based start-up is currently raising funds for human trials, drug development, formulation and mass production

Clavis Pharma receives US Orphan Drug Designation for CP-4126 to treat pancreatic cancer

Nuevolution A/S - Kopenhagen, Denmark

Amgen Announces FDA Licensure of Two New Manufacturing Facilities - Company Continues to Meet Increased Demand for Its Novel Therapeutics

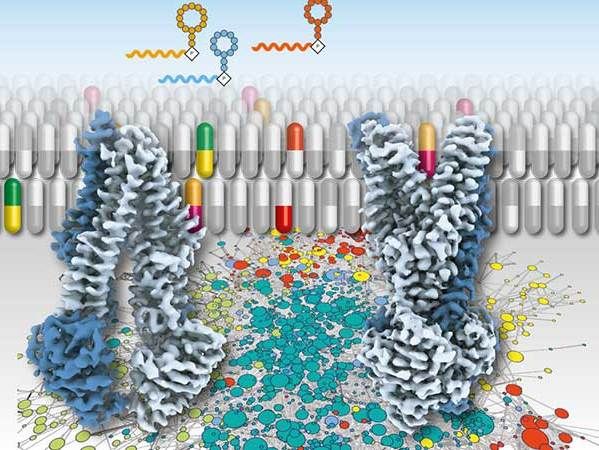

Drug-induced cellular membrane complexes induce cancer cell death - New sub-cellular complex discovered

Fraunhofer-Institut für Biomedizinische Technik (IBMT) - Potsdam, Germany

DIREVO and Pfizer collaborate on therapeutic proteases

Sun Pharma to acquire Pola Pharma

Domainex appoints Timo Veromaa as Executive Chairman

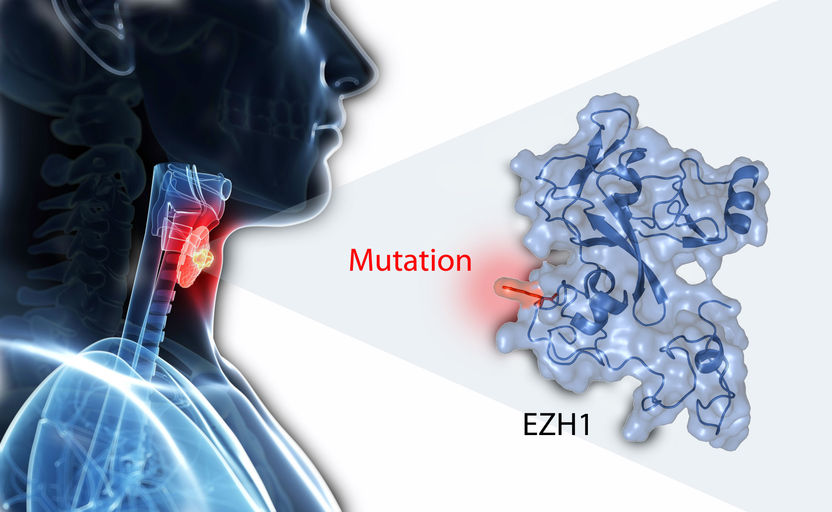

Thyroid tumour: it takes two to tango