Atrium acquires Douglas Laboratories

Atrium Biotechnologies Inc. announced the acquisition of Pittsburgh-based HVL Inc. ("Douglas") whose main brand is Douglas Laboratories. Douglas has been marketing health and nutritional products through healthcare practitioners for over 50 years and has current annual revenues of approximately $80 million. By acquiring Douglas, Atrium now positions itself as the leader in this industry throughout the United States.

The transaction is immediately accretive, enabling Atrium to increase its adjusted earnings before interest, income taxes, depreciation and amortization (EBITDA) from approximately $31 million to about $48 million on a pro forma basis and therefore also increasing earnings per share of the Company by more than 50%, before synergies. Following the transaction, Atrium's pro forma revenues will exceed $315 million.

Under the agreement, Atrium will acquire Douglas for the total amount of $107 million ($US92 million), representing approximately 6.4 times the adjusted EBITDA generated by Douglas. Approximately $97 million will be paid in cash while the remainder, approximately $10 million, will be paid in Atrium subordinate voting shares issued to certain Douglas management shareholders at a price of $10.95 per share. The cash portion will come from cash on hand and the newly renegotiated credit facility that can be increased to $200 million, under certain conditions.

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

More news from our other portals

Last viewed contents

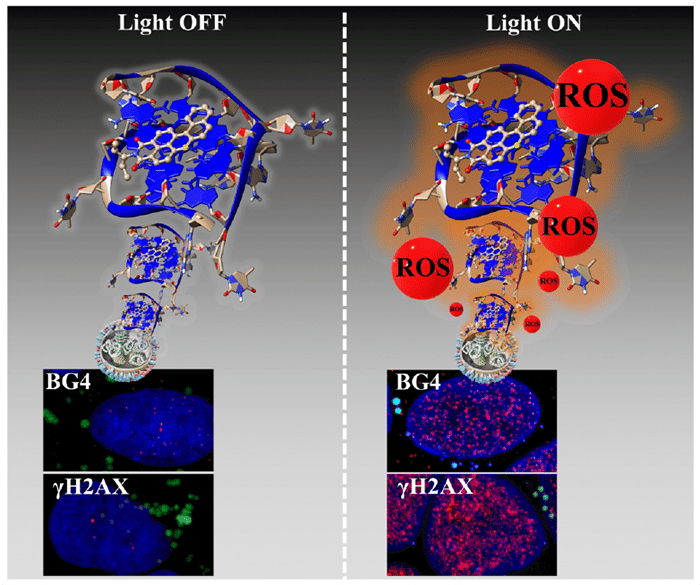

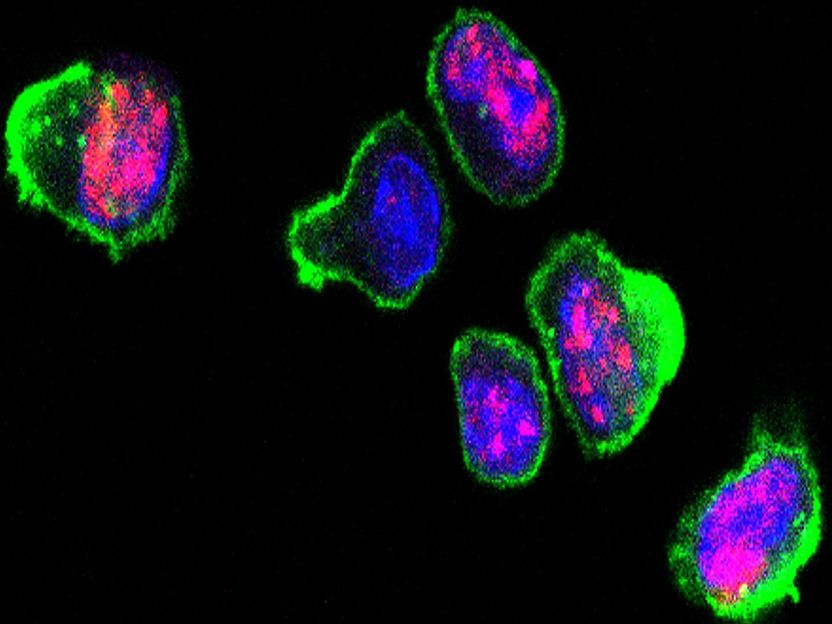

Experimental therapy for immune diseases hits Achilles heel of activated T cells

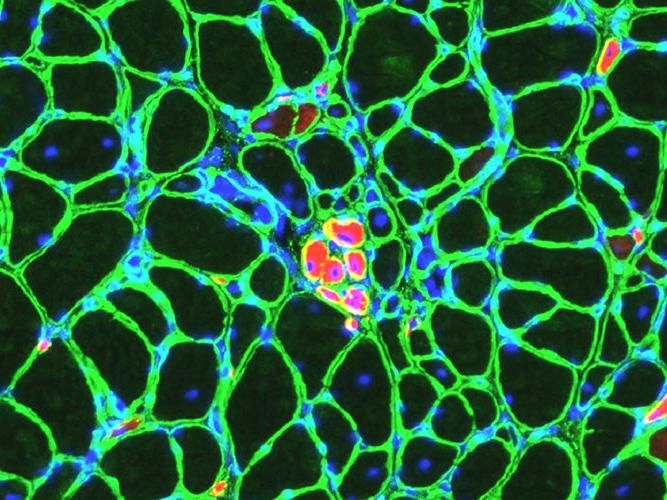

Therapy for muscular dystrophy: A new start-up - To date, there is no treatment for this life-threatening genetic disease

A self-cleaning surface that repels even the deadliest superbugs

Maple syrup protects neurons and nurtures young minds - How maple syrup prevents the development of amyotrophic lateral sclerosis in the C. elegans worm

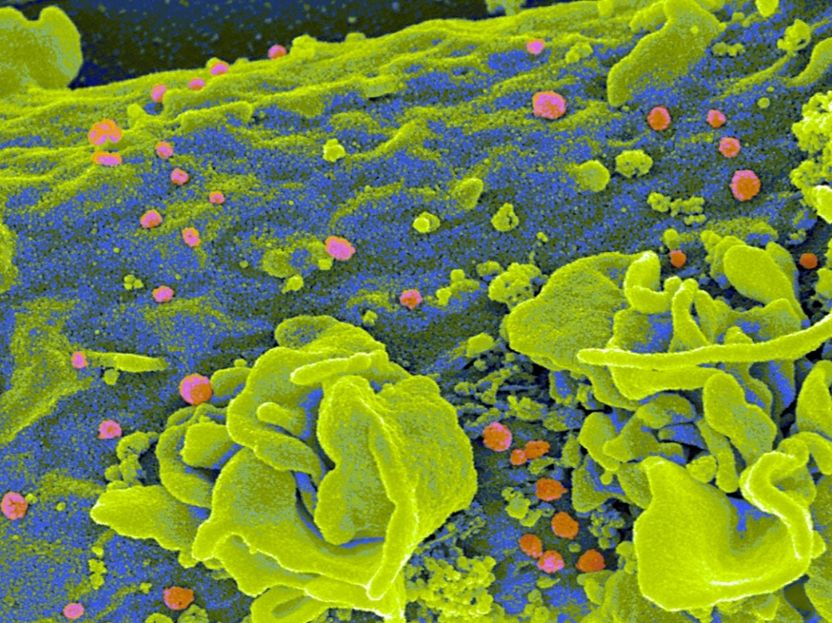

HIV infection: the brevity of the right moment

EuropaBio Responds to the Eurobarometer on Biotechnology 2010

The 'blue' in blueberries can help lower blood pressure

Laser treatment may boost effectiveness of brain tumor drugs

Deuteromycota

Proteomics can improve breast cancer treatment