Oxfordshire: Survival of the Fittest in the Bioscience Jungle

Oxfordshire Bioscience Network publish the 2005 Oxfordshire Bioscience Cluster Report

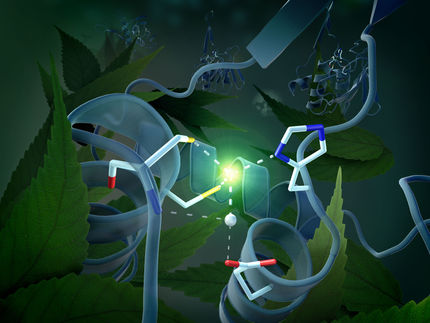

Advertisement

If you are looking for better than average odds of finding finance and surviving in the bioscience jungle, Oxfordshire is the place to be and gives you better than average odds. This is the conclusion of the 2005 Oxfordshire Bioscience Cluster Report, published today by the Oxfordshire Bioscience Network. It describes a maturing cluster that has survived the recent downturn in the biotechnology industry extremely well. The cluster is in good shape to sustain growth in the future and maintain a global competitive position.

Key findings include:

- The report cites some 66 bioscience companies in the Oxfordshire region

- 2004 was a record year for the number of new companies, with 8 new companies being formed, such as Surface Therapeutics, showing that the start-up culture continues to thrive in the region

- The cluster is well-balanced, with about 1/3 of companies at spin-out, first round stage, 1/3 at second round financing stage and nearly 1/4 publicly quoted

- Public companies in the region are thriving, for example, Oxford BioMedica, which was formed as a spin out from Oxford University in 1995, today has a market capitalisation of ?133.46m, an increase over the last 2.5 years of 794%, illustrative of the strength of the companies in the region

- The region is also home to newly listed companies, such as Vastox, which listed on AIM in October 2004

- The region has matured since that last report, with a much greater focus now on product development

- Oxfordshire bioscience companies have a total of 53 drugs in clinical trials and the cluster has become an established feeder for the pharmaceutical industry, as typified by PowderMed's deal with GSK

- Despite the challenging financial environment for biotechnology companies, Oxfordshire companies have been remarkably successful in fundraising, raising a disproportionately high share of the private funds going into biotechnology

- Oxfordshire companies raised a total of ?35m in 2004, 1/6th of the UK total, reflecting the success the region's companies have had in aligning their strategies with investor sentiment and placing increasing emphasis on product development

- For example, PowderMed attracted the ?20m in venture financing, the third largest venture round in the UK in 2004, and in 2005, Oxagen raised ?31.6m, the largest round in Europe this year to date

- Several spin outs of earlier successful Oxfordshire founded companies have chosen to stay in the region

- For example, PowderMed was spun out of Chiron after its acquisition of Powderject, Oxford Genome Sciences was spun out of Celltech as a result of its acquisition of OGS, and (OSI) Prosidion was spun out of OSI Pharmaceuticals.

- When questioned about the benefits of being located in the region, two thirds of the companies surveyed said they would not consider relocating out of the region, even if premises proved difficult to find.

Commenting on the continuing success of the cluster and its maturity, David Laskow-Pooley, Chair of the Oxfordshire Bioscience Network said:

"Those who have weathered the storm over recent years are stronger as a result and will have valuable experience to support the others in the cluster as it develops. The existence of the cluster in itself has helped to ensure the health of the industry in the region, as it contributes to an environment supportive, not only of survival, but of healthy growth. This is the key benefit of being part of a cluster and the Oxfordshire Bioscience Network plays a vital role in ensuring we make the most of this situation."

In his foreword to the report, Lord Sainsbury of Turville, Minister for Science and Innovation, who has long-standing ties with the Oxfordshire Bioscience Network, celebrates the success of the cluster, despite the recent downturn, and looks forward to following the continued growth and progress of bioscience in the region.