API Companies Look for Solutions to Problems of Overcapacity

Lack of Capability Differentiation and Competition from Low-cost Manufacturers

Manufacturers in the crowded and highly fragmented European active pharmaceutical ingredients (API) market are struggling to overcome a variety of challenges. One of the most pressing of these is the problem of overcapacity. Additionally, constant price erosions and the large number of participants present in the market combine to create other challenges such as a lack of capability differentiation.

New analysis from Frost & Sullivan reveals that the total European API market generated revenues of about USD 4.50 billion in 2003. This is projected to increase at a compound annual growth rate (CAGR) of 3.8 per cent to reach USD 5.85 billion in 2010.

While the innovative segment is forecast to experience slow growth, the market for API in generics is on the upswing, driven by a combination of factors such as the ageing population, growth of chronic therapies, cost constraints on social security systems, patent expiries and a thinning pharmaceutical drug pipeline.

The reduced outsourcing of API manufacturing - due to a lack of new drugs and the unforeseen failures of several late-stage drugs - has created a huge overcapacity in the market. This overcapacity is also due to the fact that many current Good Manufacturing Practice (cGMP) manufacturers had made extensive investments in anticipation of strong growth in the custom manufacturing business.

In the absence of steady business from pharmaceutical customers, companies are now exploring fresh opportunities in niche segments and in biopharmaceuticals. Good growth opportunities are especially anticipated for smaller suppliers that are technologically sound in niche areas such as high potency APIs.

"Growing demand for new APIs by biopharmaceutical companies with innovative drug mechanisms provide opportunities for API manufacturers," remarks Frost & Sullivan Research Analyst Himanshu Parmar. "Encouraging growth in the biotechnology sector indicates a promising future for APIs."

Biopharmaceuticals, which currently constitute around eight per cent of the world drug market, are gaining increasing importance and experiencing double-digit growth rates. This can only spell good news for the API market. Again, the ongoing development of novel drugs and a rapidly ageing population will ensure continued demand for innovative APIs and positively impact market growth.

Despite these encouraging factors, problems such as capability differentiation continue to challenge manufacturers to find ways to achieve some kind of distinction in the highly competitive API market. Production capabilities and technology portfolios that are on par with each other creates a difficult situation for manufacturers in Europe.

Manufacturers will therefore have to maintain strong customer relationships to ensure a steady stream of business from them. Enhancing production capabilities as well as improving service portfolios is essential for sustainable competitive advantage. Given the growing number of mergers and acquisitions in the API market, this is also likely to strengthen manufacturers' relationships with the newly consolidated companies and encourage more outsourcing by them.

"Suppliers need to perform a comprehensive revaluation of their technology and service portfolios to gain market presence," notes Mr. Parmar. "An integrated approach with speedy delivery and cost competitiveness needs to be implemented for efficient API manufacturing and considerable profit margins."

One of the biggest challenges facing manufacturers, however, is the growing competition posed by low-cost manufacturers in Asia. Asian manufacturers are able to offer cost-effectiveness as well as meet regulatory standards. In particular, India is emerging as an attractive choice for API outsourcing due to low development costs, complex synthesis capabilities, cGMP compliance and a large domestic market.

"Although current capabilities allow Asian manufacturers to target only the generic sector, they are expected to win pharmaceutical customers in the Western world as they develop greater manufacturing capacity," says Mr. Parmar. "This trend is already being seen in large pharmaceutical companies sourcing an increasing number of advanced intermediates from Asia."

In Europe, the United Kingdom, Germany, France and Switzerland are the major bases for API manufacturers for the innovative sector. Italy and Spain are showing growth potential in the generic sector; in fact, Italy has become one of the major bases for generic API manufacturers due to its advantageous patent regime.

Most read news

Topics

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Stora Enso announces startups selected for its second Accelerator Programme

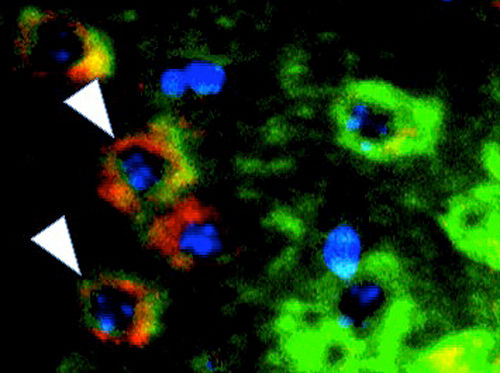

Multiple sclerosis: T cells as serial killers

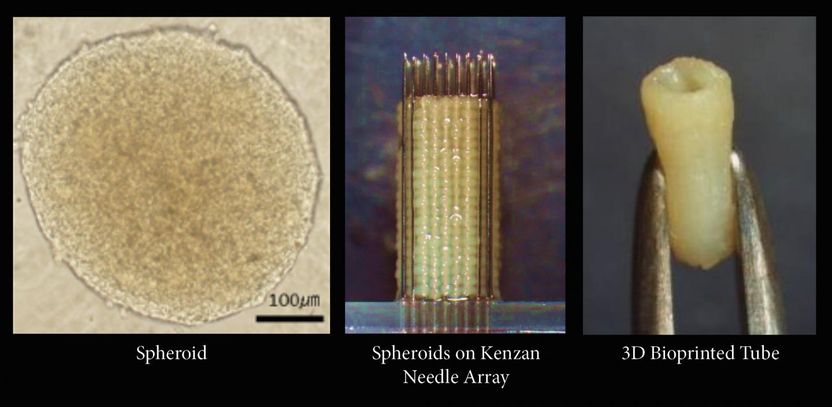

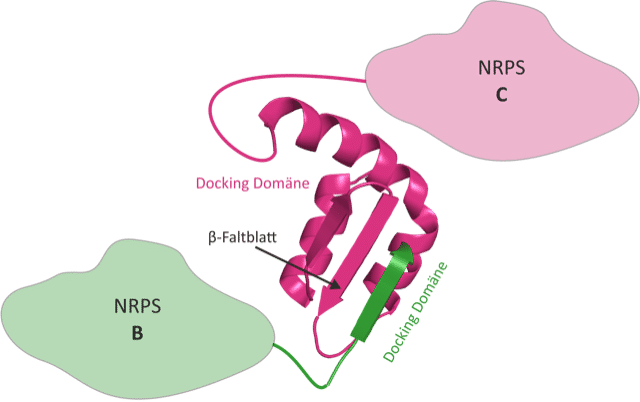

En route to custom-designed natural products - Researchers decode structure and function of docking domains in the biosynthesis of peptide natural products

ProImmune Ltd. to distribute Custom Peptide Libraries in alliance with Sigma-Genosys

Pall Expands Line of Proteomics Technologies for Full Range of Drug Discovery and Development Solutions - Opens Proteomics Service Centers to Optimize Research and Manufacturing Efficiency

List_of_EC_numbers_(EC_6)

Frost & Sullivan: Automation will represent the next step for biobanks - Exponential growth in sample volumes pushes biobanks toward

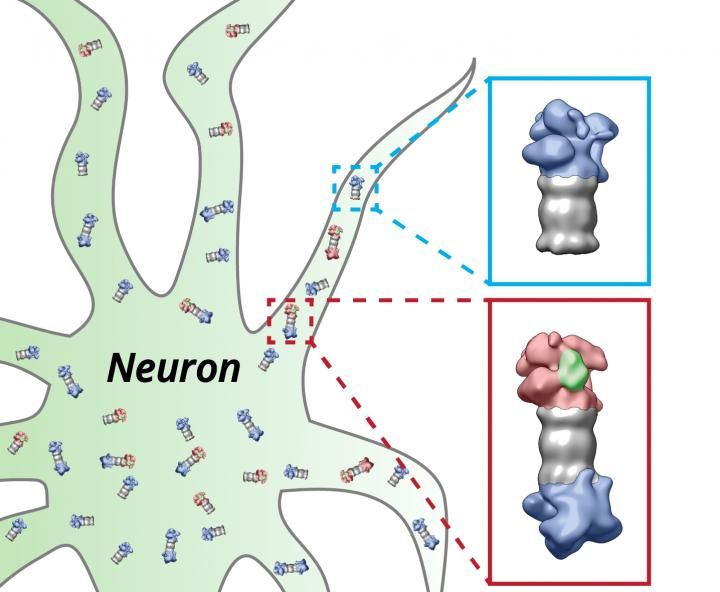

Live broadcast from inside the nerve cell

New technology could boost disease detection tests' speed and sensitivity

Rat's_Tail

Tonsillectomy