Charles River Laboratories Acquires Oncotest GmbH

Expands Oncology Capabilities of Charles River Discovery Services

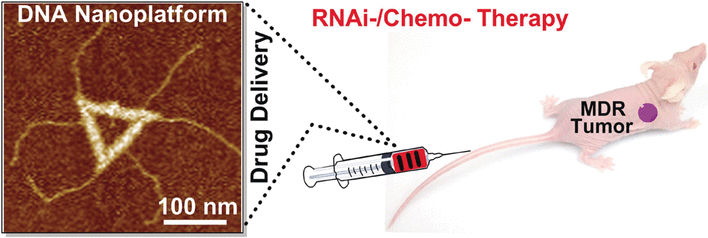

Charles River Laboratories International, Inc. announced today that it has acquired Oncotest GmbH, a Freiburg, Germany-based contract research organization (CRO) providing discovery services for oncology, one of the largest therapeutic areas for biopharmaceutical research and development spending. Oncotest offers an integrated portfolio of target discovery and validation services for preclinical oncology researchers. The company specializes in in vivo pharmacology services, leveraging an extensive collection of more than 400 patient-derived xenograft (PDX) tumor models, as well as a full range of in vitro assays using both commercially available and proprietary PDX-derived cell lines.

Integrated with Charles River’s broader portfolio of human xenografts, syngeneic, and humanized immunotherapy research models, flow cytometry, and IVIS ® imaging services, the acquisition creates a premier oncology portfolio for the validation of novel cancer therapies. With facilities in both North America and Europe, Charles River’s enhanced capabilities will enable us to provide expert support for our clients’ drug discovery programs, including: compound design and synthesis, hit-to-lead, high throughput screening (HTS), and lead-to-candidate services. When combined with Charles River’s safety assessment services, we provide unparalleled support from early discovery through preclinical development, enabling clients to bring new oncology therapies to market in a more efficient and timely manner.

James C. Foster, Chairman, President and Chief Executive Officer of Charles River said, "Global biopharmaceutical clients are increasingly demanding a full suite of oncology capabilities from a single partner, including PDX tumor models, cell lines, imaging services, and immuno-oncology tools. With Oncotest GmbH, Charles River Discovery Services now has one of the most comprehensive and translational portfolios of oncology discovery services in the early-stage CRO industry.”

Financial and Transaction Details

The purchase price was approximately €34 million in cash (approximately $36 million based on current exchange rates), subject to certain post-closing adjustments. In addition to the initial purchase price, the transaction includes a potential additional payment of €2 million based on future performance (approximately $2 million based on current exchange rates). The purchase price implies a multiple of approximately 11x adjusted EBITDA based on the trailing twelve months ended September 2015.

The acquisition will have a negligible impact on Charles River’s consolidated revenue and non-GAAP earnings per share in the fourth quarter of 2015. In 2016, Oncotest is expected to represent approximately 1% of Charles River’s consolidated revenue and be neutral to slightly accretive to non-GAAP earnings per share. Items excluded from non-GAAP earnings per share are expected to include all transaction-related costs, which primarily include amortization of intangible assets and certain third-party integration costs.

Oncotest has become part of Charles River’s In Vivo Discovery business, which is reported in the Discovery and Safety Assessment segment.

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.