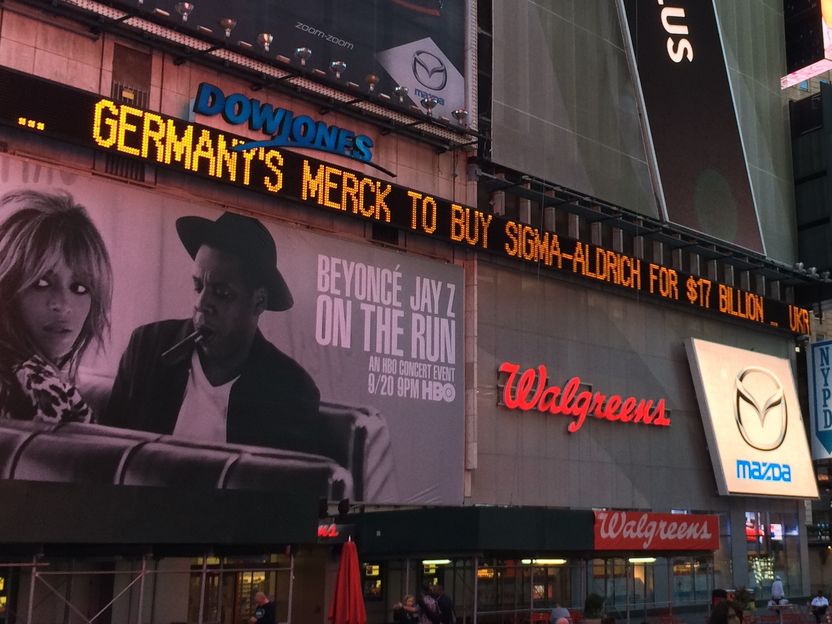

Merck Set to Complete Sigma-Aldrich Acquisition

European Commission approves sale of divestment business to Honeywell

Merck announced that following the final approval of the European Commission it is set to complete its $17 billion (€13.1 billion) acquisition of Sigma-Aldrich.

Merck KGaA

The European Commission had granted conditional approval to the acquisition of Sigma-Aldrich on June 15, 2015, subject to the divestment of certain Sigma-Aldrich assets. On October 20, 2015, Merck announced an agreement to sell parts of Sigma-Aldrich’s solvents and inorganics business to Honeywell. Now that the European Commission has approved that transaction, all necessary closing requirements have been fulfilled for Merck to complete the acquisition of Sigma-Aldrich. The formal completion date is scheduled for November 18, with the delisting of Sigma-Aldrich’s stock from NASDAQ taking effect following completion.

“We’ve reached the home stretch and are set to complete the largest acquisition in our almost 350-year history,” said Karl-Ludwig Kley, CEO and Chairman of Merck.

Merck and Sigma-Aldrich announced on September 22, 2014 that they had entered into a definitive agreement under which Merck would acquire all outstanding shares of Sigma-Aldrich for $140 per share in cash. Today’s final approval of the European Commission follows the approval of the acquisition by Sigma-Aldrich’s shareholders at a special meeting held on December 5, 2014 and the satisfaction of other customary conditions, including antitrust clearance in the United States, China, Japan and several other countries.

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.