Merck Places U.S. Bond Amounting to US$ 4.0 Billion

Placement is an important element of the financing of the proposed acquisition of Sigma-Aldrich

Merck successfully placed a U.S. bond via its U.S. subsidiary EMD Finance LLC. The oversubscribed placement is an important element of the financing of the proposed acquisition of the life science company Sigma-Aldrich, which Merck announced in September 2014.

A total of five tranches were placed, comprising floating rate and fixed rate notes. The floating rate notes have a maturity of 2 years (US$ 250 million with a 0.35% spread over 3-month U.S. dollar LIBOR). The fixed rate notes have a maturity of 3 years (US$ 400 million with a coupon of 1.70%), 5 years (US$ 750 million with a coupon of 2.40%), 7 years (US$ 1.0 billion for 2.95%), and 10 years (US$ 1.6 billion for 3.25%).

“This first U.S. bond in Merck’s history shows that with our conservative financial policy, Merck is an attractive name for investors also outside Europe. In addition, the bond is an extremely important element of the financing of the proposed acquisition of Sigma-Aldrich. The strong resonance is very encouraging and is enabling us to further diversify our investor base,” said Marcus Kuhnert, Chief Financial Officer of Merck.

The bond achieved a well-diversified distribution among a wide range of institutional investors such as fund managers, insurance companies, pension funds, and banks. Bookrunners of the transaction were Merck’s relationship banks.

In December 2014, Merck had already successfully issued a euro hybrid bond amounting to € 1.5 billion. Merck is rated A flat (negative outlook) by Standard & Poor’s and Baa1 (negative outlook) by Moody’s.

The proposed acquisition of the laboratory supplier Sigma-Aldrich for US$ 17 billion is part of the “Fit for 2018” transformation and growth program, which aims to sustainably strengthen the company’s three growth platforms – Healthcare, Life Science and Performance Materials. Merck continues to expect the transaction to close in mid-2015.

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Bothrops_asper

Raloxifene

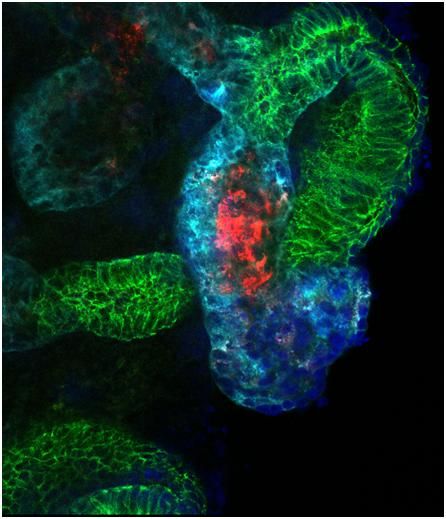

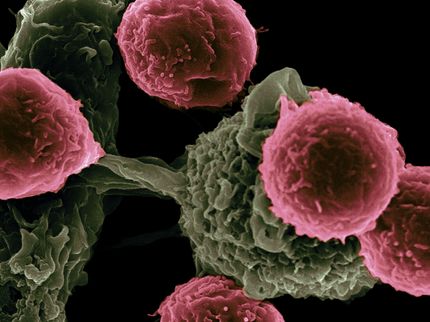

4-in-1 - Targeted gene suppression in cancer cells

First-hand expertise at the biggest ever analytica Vietnam

GE Healthcare to acquire Xcellerex Inc., broadening capabilities in growing biopharmaceutical manufacture segment - Addition of high growth company builds integrated, start-to-finish industry offering, focused on lowering costs, increasing productivity and reducing time to market