Daiichi Sankyo to Acquire Ambit Biosciences

Daiichi Sankyo Company, Ltd. and Ambit Biosciences announced that they have entered into a definitive merger agreement under which Daiichi Sankyo will acquire all of the outstanding common stock of Ambit Biosciences for $15 per share in cash through a tender offer followed by a merger with a subsidiary of Daiichi Sankyo, or approximately $315 million on a fully diluted basis. In addition to the upfront cash payment, each Ambit Biosciences stockholder will receive one Contingent Value Right (CVR), entitling the holder to receive an additional cash payment of up to $4.50 for each share they own if certain commercialization related milestones are achieved. The total transaction is valued at up to $410 million on a fully diluted basis.

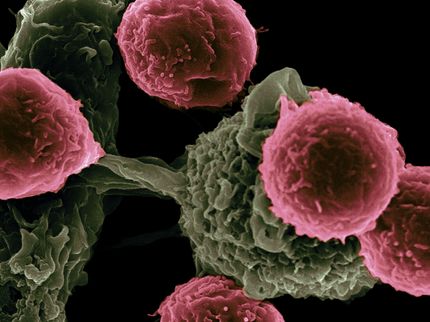

Ambit Biosciences, a publicly traded, biopharmaceutical company, is focused on the discovery and development of medicines to treat unmet medical needs in oncology, autoimmune and inflammatory diseases by inhibiting enzymes that are important drivers for those diseases. The lead Ambit Biosciences drug candidate, quizartinib, is currently in phase 3 clinical trials among patients with acute myeloid leukemia (AML), who express a genetic mutation in FLT3 and who are refractory to or relapsed after first-line treatment with or without hematopoietic stem cell transplantation (HSCT) consolidation. AML patients with the FLT3 mutation tend to have a poorer prognosis than those whose cancers are FLT3 negative.

“Daiichi Sankyo is the ideal organization to take quizartinib to the next stage of development, and ultimately, to achieve our goal of making it available as quickly as possible to help as many AML patients as possible,” said Michael A. Martino, President and CEO, Ambit Biosciences. “This attractive offer to shareholders, is a testament to the hard work and dedication of the Ambit team to our mission of developing innovative therapies for areas of high unmet medical need.”

"The acquisition of Ambit Biosciences further builds our presence in oncology to ensure we are delivering on our goal of providing world-class, innovative pharmaceuticals in core areas of unmet medical need," said Daiichi Sankyo Co., Ltd. President and CEO, Joji Nakayama. “Long-term success in oncology depends upon three pillars: fostering development of our in-house molecules, exploring mutually beneficial partnerships and executing strategic purchases, such as Ambit Biosciences, which follows our acquisitions of U3 Pharma and Plexxikon.”

“Quizartinib will fit seamlessly into our already robust oncology pipeline focused on targeted therapies with the potential for personalizing the treatment of cancer,” said Mahmoud Ghazzi, MD, PhD, Global Head of Development for Daiichi Sankyo. “With the acquisition of Ambit Biosciences, Daiichi Sankyo gains additional opportunities to develop promising treatments for cancer, including the global rights to quizartinib, currently being studied in patients with refractory AML, a very serious condition for which no new therapies have been approved for more than 30 years.”

Ambit Biosciences board of directors has unanimously approved the acquisition.

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.