Frost & Sullivan: BRIC is not delivering promises of high growth in healthcare markets

The dialogue evolves as it’s no longer about volume, cost and size

Healthcare organizations expanding into emerging markets like Brazil, Russia, India and China (BRIC) are realizing there are no shortcuts. This is proving particularly challenging, considering the current healthcare environment, especially in the United States. Companies must change the dialogue around BRIC, as it is now more about establishing value, customizing to local needs, and building regional partnerships to build a sustainable business.

“While mature economies across the globe grapple with reducing cost, towering budget deficits, and anemic growth, the BRICs are expanding rapidly and driving the global economy,” said Frost & Sullivan Partner Reenita Das during a recent analyst briefing. “Although emerging markets are often touted as the way forward for healthcare companies, recent protectionism laws and fierce competition from generics may have reduced the appeal of countries such as India and China, leading some to believe they aren’t the ‘promised land’ they once were.”

“There are currently needs often overlooked or investments in these areas that have not been sufficient enough,” said Das. “For example, the level of education and training of physicians in the BRIC countries, particularly away from the Tier 1 cities, is often a lot lower than that of physicians in mature markets. Another weak point is the lack of partnerships with local governments, NGOs and other trade organizations – this is really a very critical aspect and shows governments the level of commitment organizations are willing to make.”

Overall, the market is witnessing a slowing of growth. To further debilitate matters, the industry is seeing a changing attitude from regional BRIC governments, which is even more perplexing. In India, price cuts were introduced to make drugs or devices like stents more accessible to patients. China plans to introduce a fast-track approval process for new drugs that could exclude firms that have not conducted clinical trials in the country. Meanwhile, Russia is proposing to limit the state purchasing of foreign medicines, and Brazil has introduced higher import tariffs to encourage local industry. These trends impart a mark of further protectionism and control by the state, and more is expected to come.

“The success in the region will be less about emerging markets being cheap and more about how companies can capture the growth in these markets moving forward,” said Das. “There is a real chance for the industry to innovate in emerging markets by using disruptive technology and establishing a new commercial model that has the potential to become a relevant option for use in the developed world as well.”Das concluded: “It is very clear we need to rethink emerging market strategies and start changing the dialogue. We must move away from looking at it as a volume business in terms of large number of patients and demographics to more about where we can deliver the value to create the access that is required to meet demand.”

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

QIAGEN Acquires Biosystems Business from Biotage - Transaction adds fundamental assay technology for high-resolution sequence detection and quantification of genetic variations

2,6-Di-tert-butylphenol

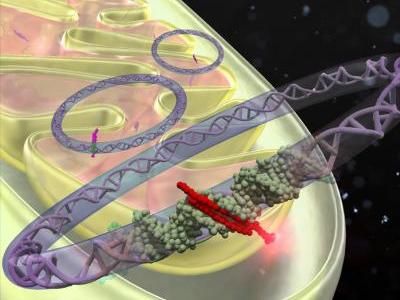

Accessing DNA in the cell's powerhouse to treat disease

Seeing the colored light - Bee brains open way for better cameras

Triastek announces research collaboration with Lilly - Application of 3D printing technology in oral delivery of drugs

US Government Awards Contract to Bavarian Nordic for the Development of Freeze-Dried IMVAMUNE Smallpox Vaccine

Ablynx Announces Positive Phase I Results for Subcutaneous Administration of it’s Anti-thrombotic Nanobody (ALX-0681)

Living in a sunny climate does not improve vitamin D levels in hip fracture patients

PolyOne Suzhou Achieves ISO 13485 Certification for Healthcare Quality Management

Researchers use cyanobacteria for the production of chemicals - Sustainable chemical processes