Complex production and sales processes weaken a company's competitiveness

Engineering, chemicals and pharmaceuticals need to catch up

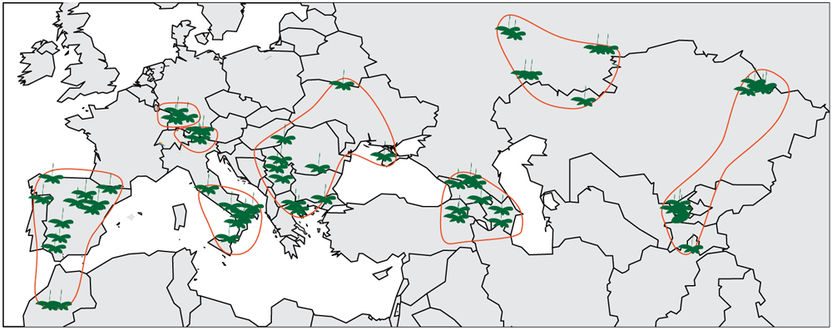

Increasingly competitive environments and the strong expansion into global markets are driving product complexity. In fact, it has more than doubled over the last 15 years. This trend makes complexity management a key success factor, as companies have to lower their production and distribution costs to remain competitive. The automotive and consumer goods industries have played a pioneering role when it comes to complexity management. Both sectors have succeeded in containing the growth of complexity in products and components by means of intelligent strategies. By contrast, engineered products, chemicals and pharmaceuticals are not in good shape on this score. Over the last 15 years, they have seen a surge in product complexity along with complexity issues in production and distribution. In the case of the chemical industry, complexity has risen by as much as 213%. The potential for savings here is very large. Dedicated complexity management could enable the global chemicals industry to reduce its production costs by up to EUR 49 billion a year. The same approach could save engineered products companies as much as EUR 54 billion, while pharma sector savings are potentially EUR 9 billion. These are some of the findings of a study entitled "Mastering product complexity" by Roland Berger Strategy Consultants.

"Customers have increasingly differentiated demands, and product lifecycles are getting ever shorter," explains Thomas Kwasniok, Partner at Roland Berger Strategy Consultants. "In a number of industries this leads to growing product complexity – a problem many companies can barely cope with. If they want to keep on top of production costs and remain competitive, they must manage this complexity in a carefully planned way."

Complexity threatens competiveness

Product complexity has more than doubled across all industries in the last 15 years. Over the same period, the average product lifecycle has been shortened by 24% – even halving in the consumer goods sector. Yet so far, the responses to these production challenges have varied widely in different industries.

"Industries like automotive and consumer goods have already done a lot of work in recent years to actively counter rising complexity," explains Steffen Kilimann, Roland Berger expert and co-author of the study. "Thanks to standardization and modularization, they have managed to limit the growth in raw materials and components, for instance – keeping it at 27% in automotive and to 35% in consumer goods."

Inventory management becomes a key factor here. Due the shortening of product lifecycles, companies find it difficult to maintain the optimum stock levels in the supply chain that ensure rapid and on-time delivery. The problem is exacerbated by the growing diversity of customer needs and requirements: "Companies supply different market segments and different countries," Kwasniok points out, "so it becomes increasingly difficult for them to anticipate sales volumes for particular products and plan their supply chains accordingly. The more fragmented a product portfolio, the smaller the volumes sold and the higher the fluctuations in demand."

Chemicals, pharma and engineered products lagging behind

Not all sectors of industry have taken steps to face down growing complexity in production and distribution at the global level. Over the last 15 years, some industries have seen huge increases in product complexity. Examples here are chemicals (+213%), engineered products (+116%) and pharmaceuticals (+123%).

"The strong growth in complexity in the chemicals industry is mainly explained by the fact that product differentiation in chemicals took off much later than in other industries," notes Kwasniok. "Chemical companies have increased their value creation in recent years and moved closer toward the end customer. This clearly entails greater product complexity."

The study finds that effective complexity management would deliver considerable competitive advantages for companies in the global chemical industry. Roland Berger experts calculate that the industry could save up to EUR 49 billion a year in product costs. The international engineered products sector could cut its production and materials costs by as much as EUR 54 billion a year, the pharma industry by up to EUR 9 billion.

Four approaches to mastering complexity

To control this diversity more effectively and drive down costs, businesses can look at four different levers: optimizing the product structure, segmenting the supply chain, integrating the supply chain, and flexibilizing production.

- Optimizing the product structure: Through standardization and modularization, companies can handle a high degree of product complexity with relatively few components. Having fewer components allows them to streamline their processes and reduce costs in purchasing and production. What's more, firms are able to shift the manufacturing of various products toward the end of the production process and establish order-driven processes in assembly and packaging.

- Segmenting the supply chain: To supply different market segments, companies also have to configure their supply chains in different ways. Consumer goods manufacturers, for instance, need a more flexible supply chain for niche products and new product launches so that they can better respond to market demand.

- Integrating the supply chain: Both internal staff and external partners must be better integrated in information flows, which can make global production and distribution processes faster and more efficient. This lever also encompasses integrating global IT systems and setting up standardized KPI and incentive systems.

- Flexibilizing production: As product complexity grows, companies should consider segmenting their production systems and introducing flexible manufacturing areas. They also need to shorten throughput times in their order processing and production so they can respond faster to changes in demand.