Meda acquires Alaven, a US specialty pharma company

Meda has signed an agreement to acquire the US specialty pharmaceutical company Alaven. The acquisition will significantly enhance Meda’s marketing capabilities in the US and expand the therapeutic focus to include both gastroenterology and women’s health; areas that Meda already operates in outside of the US.

In addition, Alaven has a strategic OTC platform that accounts for approximately 25% of sales. The OTC business will further diversify Meda’s revenue base in the US, as well as serve as a platform for commercializing strategic pipeline opportunities.

Since its founding, Alaven has demonstrated steady increases in sales by combining acquisition of strategic assets, organic growth on current products and efficient line extensions. Annual sales are approximately 800 MSEK with EBITDA margins that are similar to Meda’s. Alaven has approximately 180 employees, of which 150 are dedicated to marketing and sales. All manufacturing is outsourced to third parties.

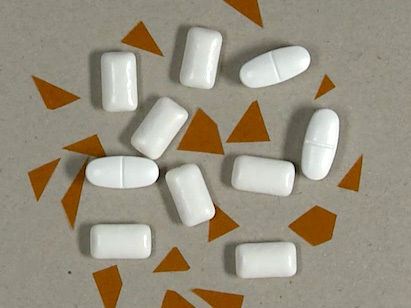

Alaven’s diversified product portfolio consists of several well known brands. The largest product, Proctofoam (rectal inflammation), has an annual turnover of about 25 MUSD. Other significant products include Cortifoam (ulcerative proctitis), Epifoam (primarily indicated for pain from episiotomy), Levsin (antispasmodic agent, adjunctive therapy in treatment of peptic ulcers), Rowasa (distal ulcerative colitis), TriLyte (colonoscopy preparation) and the Prefera brand of prenatal vitamins. In addition, Alaven has several development opportunities which are expected to launch over the next three years.

“Alaven’s products and business model are very similar to Meda’s and we look forward to integrating their proven capabilities. The acquisition of Alaven enables our operations in the US to become stronger and more profitable by taking advantage of cost and marketing synergies. It is not easy to find US specialty pharma companies of this caliber, therefore we are very pleased,” said Meda CEO Anders Lönner.

Meda will pay 350 MUSD on a cash and debt free basis. Net debt is estimated to 63 MUSD. The acquisition of Alaven is expected to be accretive to Meda’s earnings per share already during 2011. The transaction is fully financed by Meda’s existing credit facilities. Closing of the transaction is subject to standard closing requirements and antitrust clearance from the US Federal Trade Commission. The acquisition of Alaven is expected to be completed by early October.

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.