Myricx Bio raises £90 million ($114 million) Series A financing

Michael Bauer from Novo Holdings and Lucille Conroy from Abingworth will join Myricx Bio Board of Directors

Advertisement

Myricx Bio, a UK biotech company focusing on the discovery and development of a completely novel class of payloads for antibody-drug conjugates (ADCs), announced the closing of its Series A financing raising £90m ($114m). The round was co-led by new leading life science investors Novo Holdings and Abingworth. Additional new investors British Patient Capital (a wholly owned commercial subsidiary of British Business Bank plc, the UK government’s economic development bank), cancer Research Horizons and Eli Lilly and Company also participated alongside founding investors Brandon Capital and Sofinnova Partners.

In connection with the financing, Michael Bauer from Novo Holdings and Lucille Conroy from Abingworth will join Myricx’s Board of Directors.

The funds will be used to build out Myricx’s proprietary N-Myristoyltransferase inhibitor (NMTi) ADC payload platform and to advance its pipeline of NMTi-ADCs through clinical proof of concept targeting clinically validated tumour-associated antigens.

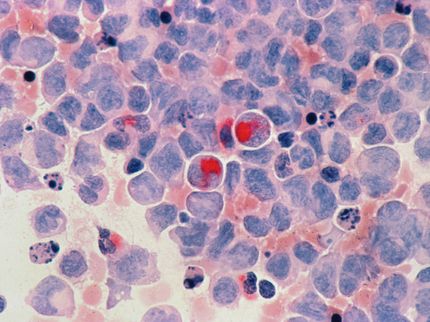

NMT is an enzyme that adds a specific lipid modification to several protein targets that are key to cancer cell survival. Myricx is advancing a pipeline of ADCs to address serious unmet needs in oncology based on its NMTi payload chemistry platform and has demonstrated excellent preclinical efficacy and safety across multiple solid tumour-associated antigens and cancer cell types.

Myricx has shown that its initial NMTi-ADCs achieve complete and durable tumour regressions, at well-tolerated doses, in multiple solid cancer models that are refractory to Topo1i-based ADCs. In addition, these NMTi-ADCs demonstrate potent bystander activity, and deliver high efficacy in patient-derived xenograft (PDX) organoid models across a broad range of antigen expression levels.

Michael Bauer, Partner in the Venture Investments group at Novo Holdings, said: “Myricx has gained unique insights into the biology of NMT and its orthogonal and differentiated mechanism. The scientific rationale behind its novel payload chemistry gives us confidence that NMTi-ADCs have the potential to greatly expand the current repertoire of ADC applications beyond the current standard-of-care payload classes, creating opportunities for new treatment options for patients. This investment reflects our strategy of investing in highly innovative and high impact biotechs, and we look forward to supporting the progress of Myricx through the clinic.”

Lucille Conroy, Principal at Abingworth, said: “We were impressed by the compelling preclinical data validating Myricx’s first-in-class payload platform based on NMT inhibition. We are pleased to co-lead the investment with Novo Holdings and to be working with the company to advance its NMTi-ADC candidates to address serious unmet needs in oncology by offering new options to patients.”

Jonathan Tobin, Partner at Brandon Capital, said: “Having recognised the potential of NMT inhibitors as a powerful ADC payload, what Robin and the Myricx team have generated to validate that potential over the past year is truly impressive. Together with Sofinnova, we are delighted to welcome the new investors into this series A financing to join us in supporting Myricx to become a significant player in the ADC space.”

Maina Bhaman, Partner at Sofinnova Partners, said: “We’ve been strong supporters of Myricx Bio since its inception, recognising the potential of its NMT inhibition platform. We are delighted to be joined by Abingworth, Novo Holdings, Lilly, Cancer Research Horizons and British Patient Capital as we continue to champion Myricx’s ability to harness the enormous potential of ADC payloads. With these expanded resources, Myricx is poised to fully leverage its NMTi-ADC platform, advancing both its own pipeline and strategic partnerships.”

Myricx was founded by Prof. Ed Tate, Dr Roberto Solari and Dr Andrew Bell. Dr Robin Carr joined the team from GSK in 2019 and has spearheaded the company’s pivot from a focus on NMTi as small molecule drugs to their potential as ADC payloads. Myricx now has the resources to grow from a virtual company into a fully-fledged R&D company with its own laboratories and an in-house R&D team, with expanded management capabilities. Currently located in the London Kings Cross biotech hotspot and with foundations in London, having spun out of Imperial College London and the Francis Crick Institute, Myricx is committed to significant growth and executive presence in London.

Myricx Bio CEO, Dr Robin Carr said: “I am truly grateful for the support of our founding investors Brandon Capital and Sofinnova Partners as we developed our initial NMT inhibitor chemistry and demonstrated the potential of NMTis as ADCs. I am delighted to welcome our new investors and thank them for their support as we enter our next phase of development. Myricx now has the resources to grow into a fully-fledged R&D company with our own laboratories, and an in-house R&D team with expanded management capabilities. Consequently, we are well positioned to build on our NMTi ADC platform and advance our pipeline as we become a clinical stage company.”

Myricx has already begun the process of attracting top talent to the company. In 2023, it appointed Chris Martin, a renowned biotech company founder, director and entrepreneur, and co-founder of ADC Therapeutics SA, to the Board of Directors as its independent non-executive Chair. It also appointed Francesca Zammarchi PhD, previously Head of Preclinical Pharmacology at ADC Therapeutics, as its Chief Scientific Officer, and Robert McCleod MD, ex-Daiichi Sankyo, as VP Clinical Development, both of whom bring considerable ADC experience.

Other news from the department business & finance

Most read news

More news from our other portals

Something is happening in the life science industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.