Bruker to acquire the NanoString business in an asset deal

Bruker Corporation announced that it has entered into a definitive acquisition agreement with NanoString Technologies, Inc., headquartered in Seattle, Washington, a leading provider of solutions for spatial transcriptomics and gene expression analysis.

Under the asset purchase agreement, Bruker expects to acquire substantially all of the assets and rights associated with NanoString’s business, including the nCounter®, GeoMx®, CosMx™ and AtoMx™ product lines, for approximately $392.6 million in cash, and the assumption of certain liabilities. In 2023, NanoString generated revenues of approximately $168 million.

On April 19, 2024, the transaction was approved under a court-supervised Chapter 11 sale process pursuant to Section 363 of the U.S. Bankruptcy Code, and it is expected to close in the second quarter of 2024, subject to customary closing conditions.

NanoString is a provider of life science tools for discovery and translational research with leading solutions for spatial transcriptomics and gene expression analysis. For over fifteen years, and with over 7,000 peer-reviewed publications, scientists and medical researchers have relied on NanoString’s pioneering instruments to advance biological, translational and clinical disease research.

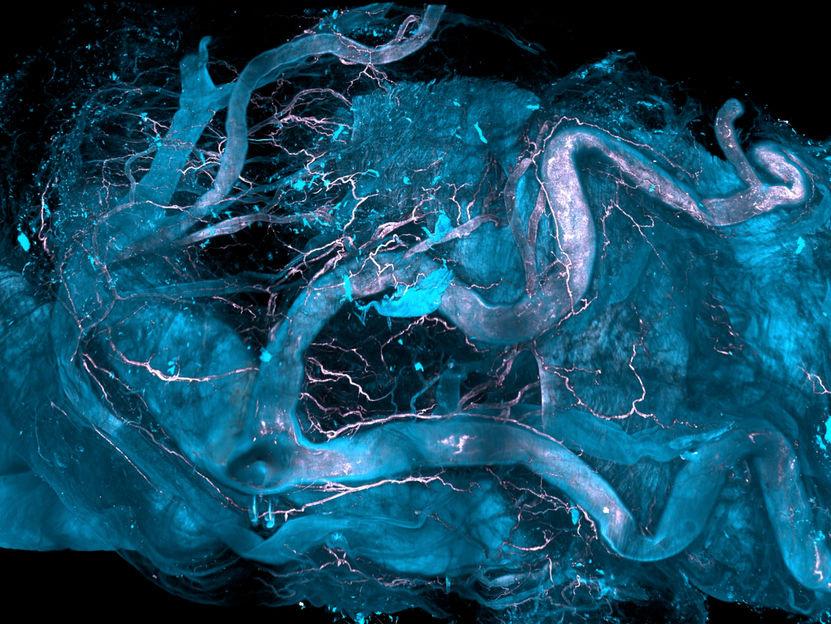

“The acquisition of NanoString will add gene expression profiling and spatial transcriptomics solutions and products to Bruker’s spatial biology portfolio,” commented Dr. Mark R. Munch, President of the Bruker NANO Group. “NanoString’s innovative platforms are complementary to Bruker’s high-performance CellScape™ spatial proteomics platform. Over time we expect considerable, high-margin consumables pull-through, which is inherent in spatial and single-cell biology solutions.”

Bruker expects to fund the acquisition with cash on hand and established debt instruments. Following the closing, the NanoString business will become part of the Bruker Spatial Biology business.

Bruker is unable to provide guidance estimates for the NanoString business for the remainder of 2024, as its financial performance cannot yet be reliably estimated, given the disruption of the Chapter 11 reorganization, the previous European Unified Patent Court’s injunction on CosMx sales (which has since been lifted), and the uncertainties of various US and European IP and antitrust litigation proceedings against an unusually aggressive, larger spatial and single-cell biology competitor.

As a preliminary estimate, for the remainder of 2024, the transaction is expected to be dilutive to non-GAAP EPS by $0.15 to $0.20.

By 2026, Bruker expects the NanoString business to have rebounded and to be near break-even with resumed revenue growth and margin improvements, also taking advantage of deal synergies, as Bruker is not acquiring NanoString’s public company overhead in this asset deal.

Frank H. Laukien, Bruker’s President & CEO, added: “Bruker regards Spatial Biology as a key pillar of our strategic focus on the post-genomic era. For 2027 and beyond, we expect our combined Spatial Biology business to achieve double-digit organic revenue growth with increasing non-GAAP EPS accretion. Bruker has a proven management process and an experienced leadership team with a successful track record of integrating acquisitions and improving their profitable growth performance substantially over the years, while generating an attractive return on invested capital.”

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

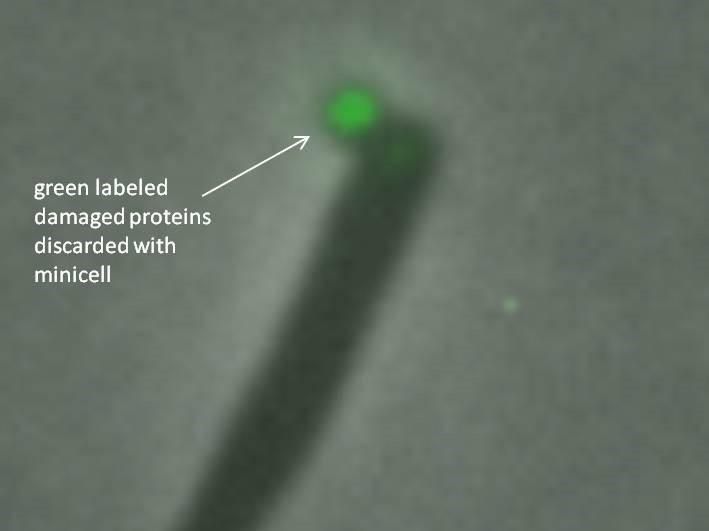

Taking out the (life-threatening) garbage - Bacteria eject trash to survive

Saint_Anthony's_fire

New Collaborations and Advancements in RNA-Based Drug Development Programs Lead Santaris Pharma to Establish US Operations - Santaris PharmaAppoints Art Levin Ph.D. as President of US Operations and Chief Development Officer

Biodefense: Anthrax and Smallpox at the Research Forefront

Senile_osteoporosis

NIH_funding_of_IBS_Research

Researchers to Decode Antarctic Ice Metagenome with the 454 Sequencing System, to Explore the Effects of Climate Change

Study uncovers the structure of 1 adrenergic G-protein-coupled receptor (GPCR) - Structure of important drug target elucidated using Heptares' StaR(TM) technology

Ribosome

Blood_alcohol_content

UCB announces Phase 3 clinical trial program for epratuzumab in Systemic Lupus Erythematosus did not meet primary endpoint