Sanofi to acquire Kadmon

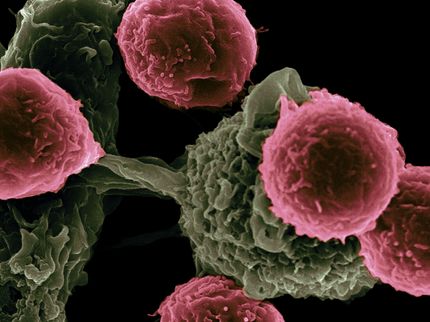

Sanofi has entered into a definitive merger agreement with Kadmon Holdings, Inc. a biopharmaceutical company that discovers, develops, and markets transformative therapies for disease areas of significant unmet medical needs. The acquisition supports Sanofi’s strategy to continue to grow its General Medicines core assets and will immediately add Rezurock™(belumosudil) to its transplant portfolio. Rezurock is a recently FDA-approved, first-in-class treatment for chronic graft-versus-host disease (cGVHD) for adult and pediatric patients 12 years and older who have failed at least two prior lines of systemic therapy.

Shareholders of Kadmon common stock will receive $9.50 per share in cash, which represents a total equity value of approximately $1.9 billion (on a fully diluted basis). The Sanofi and Kadmon Boards of Directors unanimously approved the transaction.

“We are transforming and simplifying our General Medicines business and have shifted our focus on differentiated core assets in key markets,” said Olivier Charmeil, Executive Vice President General Medicines. “We are thrilled to add Kadmon's Rezurock to our well-established transplant portfolio. Our existing scale, expertise, and relationships in transplant create an ideal platform to achieve the full potential of Rezurock, which will address the significant unmet medical needs of patients with chronic graft-versus-host disease around the world.”

“We are excited that Sanofi has acknowledged the value of Rezurock and the deep potential of our pipeline,” said Harlan Waksal, M.D., President and Chief Executive Officer, Kadmon. “By leveraging Sanofi’s global resources and long-standing expertise in developing and commercializing innovative medicines, Rezurock is now well positioned for global accessibility, faster. I want to thank the entire Kadmon team, including management and the Board of Directors, and the Sanofi organization, for their ongoing commitment to patients and their caregivers.”

Kadmon’s pipeline includes drug candidates for immune and fibrotic diseases as well as immuno-oncology therapies.

The transaction is expected to be modestly dilutive to Sanofi’s EPS in 2022.

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.