The biotech living and the walking dead

Increasing number of university-licensed startups in the U.S. are not actually operating

When it comes to startup companies spun out of universities, there are a lot of zombies out there.

When it comes to startup companies spun out of universities, there are a lot of zombies out there (symbolic image).

pixabay.com, CC0

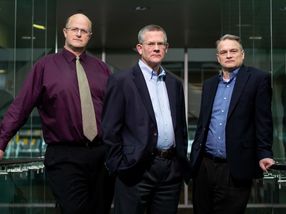

BYU professors Gove Allen and Paul Godfrey with UVU professor David Benson.

Photo by Jaren Wilkey/BYU Photo

A new study led by Brigham Young University professors, published in Nature Biotechnology, finds a significantly increasing number of university-licensed startups exist on paper but are not actually contributing economically — or even functioning. (University-licensed startups are firms formed to commercialize a life science technology developed at a university).

The analysis by BYU Marriott School professors Paul Godfrey and Gove Allen, and UVU professor David Benson, finds that nearly 40% of the most recently formed university-licensed startups from the Top-50 patent producing universities qualify as the “walking dead.” In other words, they’re startups that became real but never grew or added jobs, yet remained in the landscape for long periods of time.

While the university gets the short-term benefit of transferring the technology and credit for economic development from these zombies, the long-term impact is little to no economic development or development of the technology. The researchers discovered the oldest walking dead remained “active” for 21 years without any significant contribution to employment, patents or commercial products.

“University technology transfer offices are awarded by how many startups they found, not whether they are successful or not,” Godfrey said. “What we see, over time, is that universities tend to game the system by spinning out these companies that aren’t doing anything.”

The study represents the first ever major aggregation of data detailing the success and failures of university-licensed startups in the U.S. The data spans 31 years — from 1980 to 2011 — and took Godfrey, Allen and Benson eight years to fully compile and analyze. The trio of management professors tracked how many university-licensed startup firms are still alive, which went public, which were acquired, which died and which failed to launch, yet remained on the books.

They found in many cases these “walking dead” startups don’t even have a physical location, listing a university’s tech transfer office as its corporate headquarters and the director of the tech transfer office as its registered agent or corporate officer.

The researchers’ advice? Kill ‘em.

“Nobody wins when a startup just exists. The university doesn’t win, potential employees don’t win, the local economy doesn’t win,” Godfrey said. “We need to kill the walking dead and, in order to prevent future zombies, we need to change the reporting system for technology transfer offices.”

The authors recommend tech transfer offices report on a full palate of activities: how many startups were started this year, and of the ones started from the last five years, how many are still running, how many employees they have, how much venture funding they’ve secured and so on. Overall, universities should have a much broader measure of success for the tech transfer office.

In addition to learning about the increasingly high rate of false start startups, the researchers also learned quite a bit about what makes the successful ones thrive. Another takeaway from the data is the power of clusters for helping incubate startups. The data showed a significant positive effect for firms located in a cluster (think Boston, San Diego, the Bay area): They experience success twice as often and failed half as often. But the analysis also revealed more nuance about clusters: Moving to a new micro-cluster is even more beneficial.

While everyone rightly thinks of Silicon Valley as the cluster location for tech startups, the researchers found there are many other places where clusters provide important nurturing — and that isn’t necessarily in the university’s backyard.

The researchers discovered that startups that moved away from the footprint of their university and found a home in a micro-cluster with the right resources (think of Irvine, Calif., with its resources for eye healthcare companies) thrived even more. This finding is important because universities tend to put rules on startups that keep them located nearby. Researchers suggest universities let startups find the right geographic location and focus on increasing resources in a more specific niche.

“A lot of universities and states put constraints on startups, so they don’t move; that’s not good policy,” Godfrey said. “Don’t constrain companies from moving, but build a destination where very specific companies want to come.”

The team hopes their work will help entrepreneurs, university administrators, and public policy makers make changes that will realize the goals of technology transfer: economic growth, meaningful employment, and new technology development.

Original publication

Other news from the department business & finance

Most read news

More news from our other portals

Something is happening in the life science industry ...

This is what true pioneering spirit looks like: Plenty of innovative start-ups are bringing fresh ideas, lifeblood and entrepreneurial spirit to change tomorrow's world for the better. Immerse yourself in the world of these young companies and take the opportunity to get in touch with the founders.