Evotec jump-starts biologics with acquisition of Just Biotherapeutics

Evotec SE announced the signing of a definitive agreement under which Evotec will acquire Just Biotherapeutics, Inc. (“Just.Bio”), for up to $ 90 m including potential performance-based earn-out components expected within the next three years. Just.Bio is a unique technology company that integrates highly synergistic scientific expertise and ML driven technologies for design, development, and manufacturing of biologics. Founded only in 2014/15, Just.Bio has approx. 90 employees, mainly scientists, all working at a state-of-the-art discovery, development and manufacturing facility in Seattle, WA, USA. The acquisition is expected to close in the second quarter 2019.

Opens new growth opportunites as Evotec diversifies into biologics

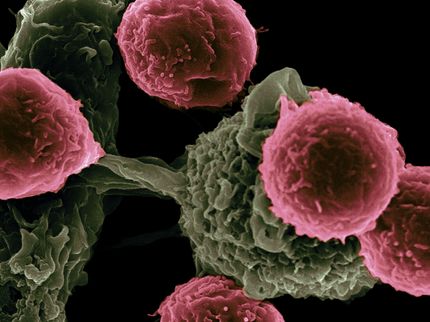

The acquisition of Just.Bio will add considerable business opportunities for further acceleration of Evotec’s long-term strategy to be the industry partner of choice for external end-to-end innovation. Evotec’s drug discovery and development value proposition today is to offer the highest quality integrated services mainly in the field of small molecules. The acquisition grows Evotec’s business into a comprehensive offering including biologics in therapeutic areas such as oncology, CNS, pain, inflammation, metabolics, and infectious diseases. Like Evotec in small molecules, Just.Bio is defined by its excellence in science and technology, defined outcomes, smart and highly efficient solutions for developing and manufacturing of biologics at highest standards, thus making an excellent fit.

Just.Bio’s capabilities and expertise comprise an in-house, integrated technology platform, J.DESIGN, enabling smart and efficient biologics’ drug development from design and lead optimisation to manufacturing:

- J.MDTM is a technology-based process development tool using Abacus™ as machine learning-based computer-aided design tool to predict and select optimial molecules for further development

- JP3® includes lab and computational tools for rapid development of a high-yielding manufacturing process along with a cGMP early clinical manufacturing facility

- Significant further potential lies in the company’s J.POD® technology for flexible and modular larger scale manufacturing of clinical and commercial stage biologics

Transaction structure reflects value potential

During recent years, Just.Bio has been able to attract a diversified customer portfolio resulting in strong financial growth. With reported 2018 revenues of approx. € 20 m, Just.Bio was able to achieve revenue growth rates that are above the general market growth. Evotec will pay a total consideration of up to $ 90 m (approx. € 81 m; €/$ fx rate of 1.117) including potential earn outs in the next three years. The initial consideration upon closing is $ 60 m1) (approx. € 54 m; €/$ fx rate of 1.117). The acquisition of 100% of the issued and outstanding equity interests of the company will be paid in cash to a syndicate of institutional investors of ARCH Venture Partners, Merck & Co., Lilly Asia Ventures and the Bill & Melinda Gates Foundation. The acquisition will add to Evotec’s revenue growth and will strengthen Evotec’s overall strategic plan. The potential guidance update will be given latest upon reporting of half-year 2019 figures. Just.Bio will be financially fully consolidated under the Evotec Group.

Dr Werner Lanthaler, Chief Executive Officer of Evotec, said: “We are excited about the acquisition and warmly welcome Just.Bio’s expert team as a new part of the Evotec family and also welcome Dr Jim Thomas in his new management role EVP, Global Head, Biotherapeutics, President US Operations. Broadening our platform into biologics has always been key to our strategy. With this acquisition we finally found the perfect match to complement our leadership in small molecules.”

Dr James Thomas, Chief Executive Officer of Just.Bio, commented: “Combining Just.Bio with Evotec creates a technological powerhouse that will fuel our long-term mission to make important biologics accessible to patients worldwide. We are thrilled to be part of the Evotec family.”