Danaher to Acquire the Biopharma Business of General Electric Life Sciences for $21.4 Billion

Danaher Corporation announced that it has entered into a definitive agreement with General Electric Company (GE) to acquire the Biopharma business of GE Life Sciences (GE Biopharma) for a cash purchase price of approximately $21.4 billion. Given anticipated tax benefits from the transaction structure, the net purchase price is approximately $20 billion. This represents a multiple of approximately 17 times expected 2019 EBITDA for GE Biopharma.

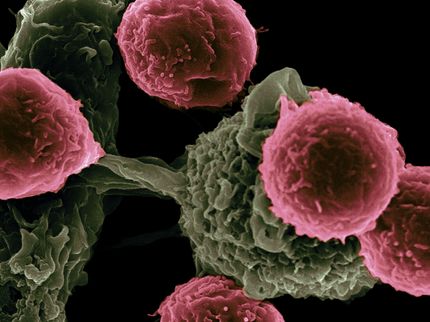

GE Biopharma is a leading provider of instruments, consumables, and software that support the research, discovery, process development and manufacturing workflows of biopharmaceutical drugs. The business is comprised of process chromatography hardware and consumables, cell culture media, single-use technologies, development instrumentation and consumables, and service. GE Biopharma is expected to generate annual revenue of approximately $3.2 billion in 2019, with approximately 75% of these revenues considered recurring.

The business will be established as a stand-alone operating company within Danaher's $6.5 billion Life Sciences segment, joining the Company's Pall, Beckman Coulter Life Sciences, SCIEX, Leica Microsystems, Molecular Devices, Phenomenex and IDT businesses.

Danaher's President and CEO, Thomas P. Joyce, Jr., said, "GE Biopharma is renowned for providing best-in-class bioprocessing technologies and solutions. This acquisition will bring a talented and passionate team as well as a highly innovative, industry-leading product suite to our Life Sciences portfolio, providing an excellent complement to our current biologics workflow solutions."

Joyce continued, "We expect GE Biopharma to advance our growth and innovation strategy in an important and highly attractive life science market. We see meaningful opportunities to harness the power of the Danaher Business System to further provide GE Biopharma's customers with end-to-end bioprocessing solutions that help enable breakthrough development and production capabilities. We look forward to welcoming this talented team to Danaher."

Danaher expects to finance the all-cash transaction with approximately $3 billion of proceeds from an equity offering (which may include an offering of mandatory convertible preferred shares), and the remainder from available cash on hand and proceeds from the issuance of debt and/or new credit facilities.

Danaher estimates the acquisition will reduce GAAP diluted net earnings per share by approximately $1.15 to $1.20 but will be accretive to non-GAAP, adjusted diluted net earnings per share by approximately $0.45 to $0.50 in the first full year post acquisition. The non-GAAP, adjusted diluted net earnings per share amounts exclude anticipated non-cash amortization, purchase accounting charges and transaction expenses attributable to the acquisition, as well as stand-up costs related to carving out the business. The dilution impact from the anticipated equity financing for the transaction is included in both of these GAAP and non-GAAP diluted earnings per share figures.

The transaction is expected to be completed in the fourth quarter of calendar year 2019, and is subject to customary conditions, including receipt of applicable regulatory approvals.

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.