Epigenomics AG Places Maximum Number of New Shares in Capital Increase with Pre-emptive Rights

Epigenomics AG successfully completed the placement of 14,697,361 new ordinary bearer shares within a rights offering representing the entire authorized capital available. The new shares were placed at the subscription price of EUR 2.25 per new share resulting in gross proceeds of about EUR 33.1 million. The rights offering started on March 15, 2010 and ended on March 29, 2010.

The subscription rate in the transaction was 46.2% equalling 6,789,613 new shares. The remaining 7,907,748 unsubscribed new shares were sold at the subscription price to retail investors as part of a public offering in Germany and Austria, as well as to selected institutional investors in Germany and abroad. This public offering was significantly oversubscribed, enabling Epigenomics AG to place the entire number of new shares. A sizeable portion of the unsubscribed new shares were placed with funds managed by Abingworth LLP, London, United Kingdom, that in addition to exercising pre-emptive rights, increased their stake in Epigenomics AG to become the largest shareholders after the capital increase. ICF Kursmakler AG (Frankfurt, Germany) acted as sole lead manager and sole underwriter.

The registration of the implementation of the capital increase with the commercial register (Handelsregister) and the admission of the new shares to the regulated market (regulierter Markt), Prime Standard, of the Frankfurt Stock Exchange is expected on or around March 31, 2010. Trading in the new shares is expected to begin on or around April 1, 2010.

With the registration of the implementation of the capital increase the total issued share capital of Epigenomics increases from EUR 29,394,724.00 to EUR 44,092,085.00.

Epigenomics AG intends to use the net proceeds from the offering to finance its current operations and to build and strengthen the marketing, sales, and distribution capacities for its products, to support ongoing and new product development for its business in cancer screening, diagnosis, disease progression and recurrence monitoring, and assessment of disease prognosis and in this areas in particular the funding of further R&D, clinical trials, regulatory approvals and market introduction of its products that are currently in its product pipeline as well as enhancing and strengthening capabilities related to regulatory affairs and clinical trials, further improvement of the DNA methylation technology, additional in-licensing agreements and strengthening its intellectual property portfolio, as well as for general corporate purposes.

Most read news

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

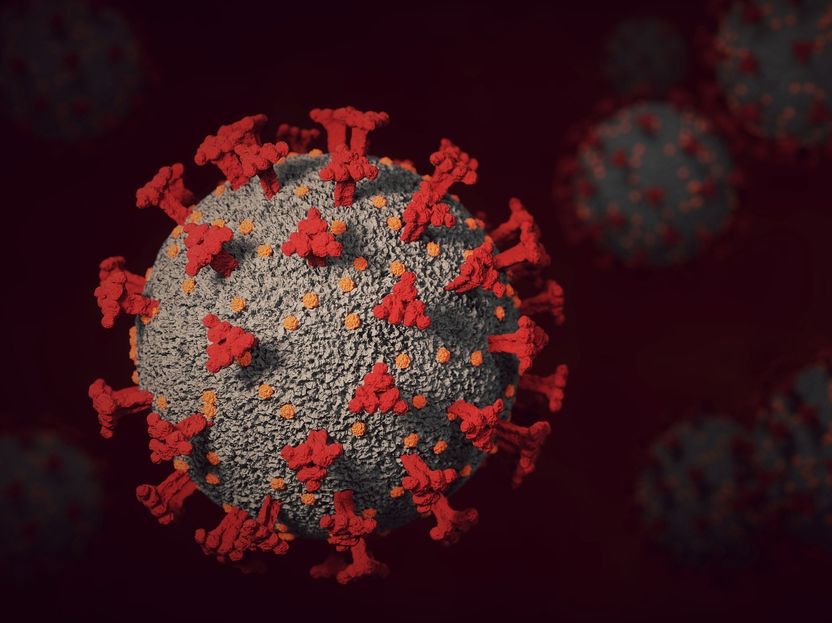

Researchers find explanation why the Omicron variant causes less severe disease - Moreover, cell culture findings indicate that eight important COVID-19 drugs and drug candidates remain effective against Omicron.

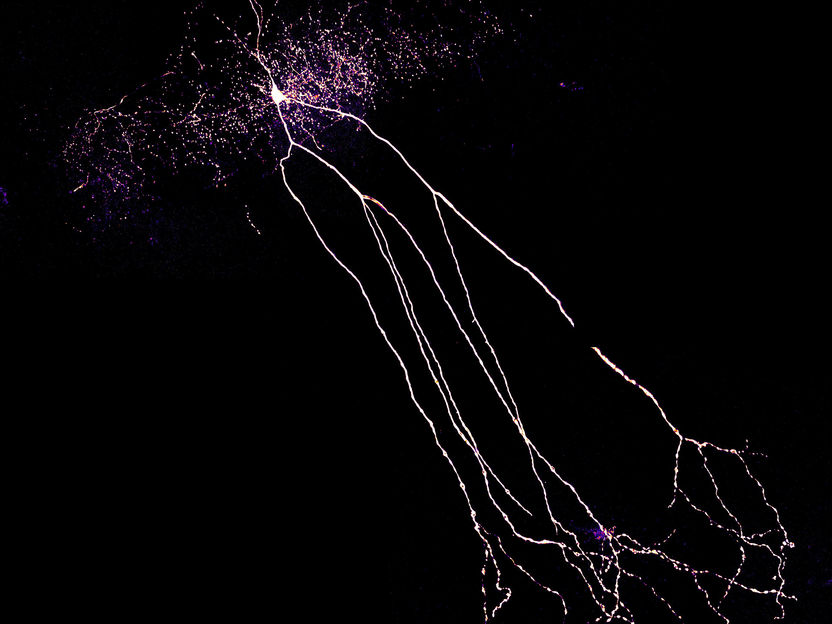

DNA computer brings 'intelligent drugs' a step closer

Biosafety cabinet with integral Particle counter | Safety cabinets | TopAir Systems

Roxana_Moslehi