Takeda announces its intention to acquire TiGenix

TiGenix NV confirms that Takeda Pharmaceutical Company Limited has announced its intention to launch a voluntary conditional takeover bid on TiGenix.

Takeda intends to acquire 100% of the securities with voting rights or giving access to voting rights of TiGenix not already owned by Takeda or affiliates at a price of EUR 1.78 per share in cash and an equivalent price in cash per American Depositary Share, warrant and convertible bond.

Takeda intends to launch the proposed takeover bid shortly after the approval of the bid prospectus and the response memorandum by the Belgian Financial Services and Markets Authority ("FSMA"). The bid will be subject to Takeda and its affiliates owning at least 85% of the securities of TiGenix with voting rights or giving access to voting rights on a fully diluted basis, as well as the following conditions precedent: the absence of a material adverse effect occurring after the date of this announcement, Cx601 obtaining European Medicines Agency approval and expiration of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 in the U.S. The European Medicines Agency approval for Cx601 is expected during the first half of 2018.

Consistent with its fiduciary duties and subject to review of the final bid prospectus, the bid is unanimously supported by TiGenix' board of directors, who will provide its formal response to the proposed takeover bid in a response memorandum which it will issue in due course in accordance with the applicable legal provisions. Takeda and TiGenix entered into an offer and support agreement confirming TiGenix' support and the terms and conditions of the bid set forth in the press release of Takeda. Cowen and Company, LLC served as financial advisor to TiGenix.

Gri-Cel S.A., holding 32,238,178 TiGenix shares, and its affiliate Grifols Worldwide Operations Ltd., holding 7,189,800 TiGenix shares held in the form of American Depositary Shares, have irrevocably confirmed that they will tender their shares and American Depositary Shares held in TiGenix into the potential public takeover bid.

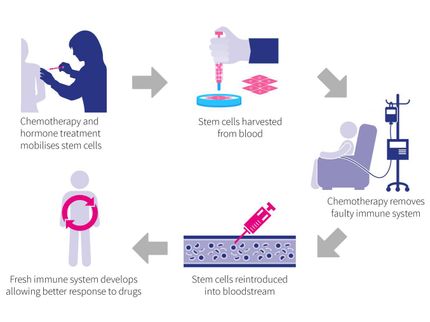

"We believe the intended takeover bid of Takeda is a positive step for TiGenix' security holders and reflects the true value of our dedication to patients over the last few years. We believe that TiGenix's expertise would help accelerate Takeda's ambition to develop novel stem cell therapies," said Eduardo Bravo, CEO of TiGenix. "Takeda is a patient centric company that offers the best capabilities and resources to ensure access to Cx601 to patients worldwide."

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.