SpePharm announces the acquisition of Savene from TopoTarget

SpePharm Holding, BV announced the acquisition of the worldwide (with the exception of North and South America) rights to Savene® from TopoTarget A/S. As part of the acquisition SpePharm will also take on the European sales force of TopoTarget. Savene®, which has been marketed by TopoTarget since its approval by the EMEA in July 2006, is the only approved product for the treatment of extravasations, or leakage out of the blood stream, of certain commonly used anticancer drugs known as anthracyclines. If not adequately and timely treated, such extravasations can lead to tissue necrosis that is sometimes of sufficient severity to require surgery including amputation.

To complete this acquisition and to finance its further growth in Europe, SpePharm also announced the closing of a €7 million equity investment by its existing investors: TVM Capital, Signet Healthcare and Paul Capital Healthcare.

At the same time, SpePharm announced a €4 million secured convertible debenture from Paladin Labs, Inc.. Concomitant with the funding provided by Paladin, SpePharm granted Paladin an exclusive license to Savene® for South Africa and Israel. The two companies will provide each other with reciprocal rights, in their respective geographies, that come from any future product acquisitions or licensing transactions. Given the strategic importance and broad nature of this relationship, Paladin will also be entitled to place a representative on the SpePharm Supervisory Board.

“We are extremely pleased to add Savene® to our product portfolio and are confident SpePharm will continue to rapidly grow its sales as we integrate this medically important orphan drug product for the treatment of patients with anthracycline extravasations into our portfolio. Savene®, together with the sales and marketing team of TopoTarget that will join us, will give SpePharm the opportunity to expand its commercial presence into several additional European countries and reinforce our position in hospital oncology departments throughout Europe”, said Jean-François Labbé, Managing Director and CEO of SpePharm.

Most read news

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

Peregrine Pharmaceuticals Doses First Patient in Clinical Trial of Bavituximab in HCV Patients Co-Infected With HIV - New Trial in Important Patient Subgroup Will Assess Safety and Anti-Viral Activity

Uncontrolled hypertension could bring increased risk for Alzheimer's disease - Major journal reports study findings

Pro Bono Bio Launches Flexiseq: A Novel Approach to the Treatment of Osteoarthritis

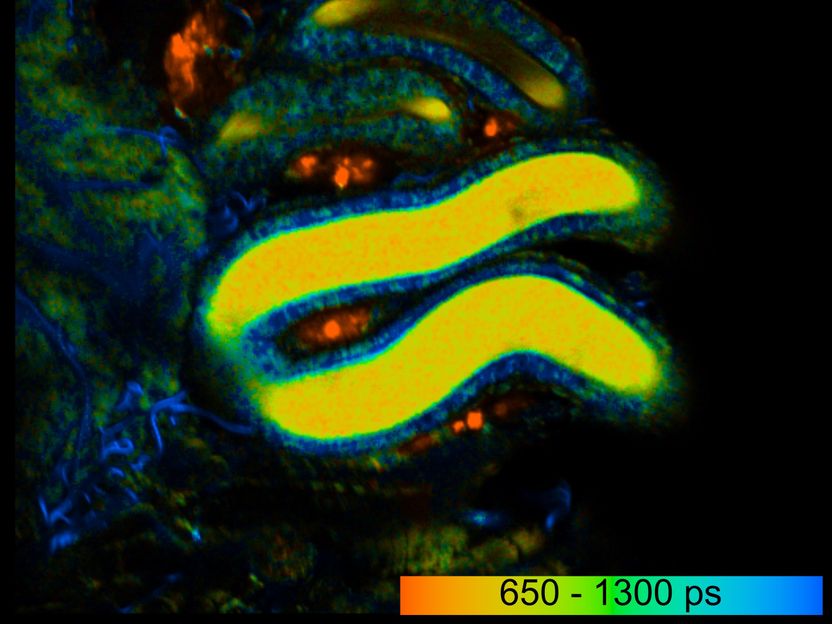

Biologists make living sperm glow

Leica Microsystems Strengthens Market Presence in Turkey

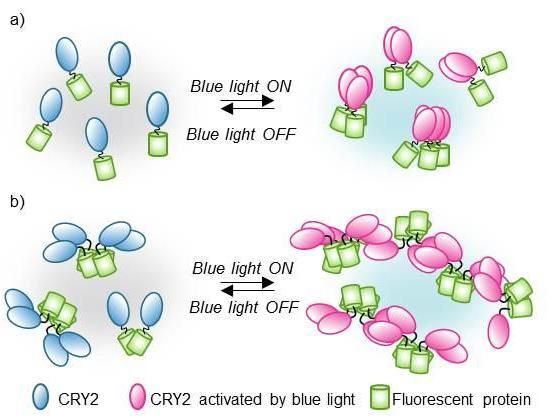

Protein mingling under blue light