Frost & Sullivan Identifies Innovative and Cost-effective Technology as Key Competitive Factor in European Medical Device Market

The medical device industry is one of the most vital and dynamic sectors of the European economy. The industry is constantly driven by R&D, which needs to keep pace with the evolving demands of the medical fraternity.

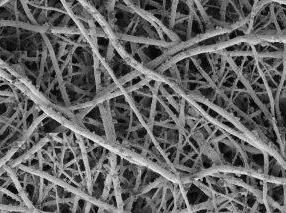

New analysis from Frost & Sullivan, European Medical Device Company Profiles, finds that the global medical device market comprises three main regions – the United States, Europe and Japan. The United States represents the largest share with approximately 40 per cent, followed by the European Union (EU) countries with 30 per cent and rest of the world with 30 per cent. The following segments are covered in the research: anaesthetic and respiratory devices, cardiology and thoracic surgery devices, minimally invasive surgical devices, neurology and neuromuscular devices, ophthalmic and optical devices, orthopaedic and prosthetic devices, single-use surgical and disposables and wound care/management and biomaterials.

A number of large international companies are active in the field of medical device manufacturing. Some, among these, are taking a leading position in the European market.

“The European medical device market is highly fragmented, with numerous niche product lines representing modest market sizes,” states Frost & Sullivan Research Associate Sree Vidhya Praveen. “Companies involved in medical device manufacturing range from large corporations producing a broad range of devices and pursuing a global marketing strategy on a worldwide scale to small and medium companies concentrating on a single product line or on a specific geographic region.”

The major competitors to European medical device manufacturers are traditionally from the United States and Japan. However, European manufacturers have a strong position in Europe, where approximately 78 per cent of the products sold are manufactured within the EU.

Despite the gloomy economic trends, most medical device companies reported positive domestic and international sales growth and continued optimism about prospects for the industry in 2009. Now that the meltdown is fading, most medical-device manufacturers’ are divulging their adaptation in times of rough weather.

Manufacturers were capable of quickly adapting to market trends and were able to achieve greater profit margins. Emerging markets in Asia, Eastern Europe and Latin America constituted areas of potential growth for these European producers.

“Innovative and cost-effective products are likely to constitute the key elements of success in future,” says Vidhya. “The extent to which European producers continue to compete depends on their willingness to engage in product differentiation, increased R&D expenditure and a coordinated research and development policy with governing authorities.”

Organizations

Other news from the department business & finance

Get the life science industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.